Mozambique to export US$5 million a month of electricity to Malawi - report

US loan could improve Mozambique’s LNG prospects:- Fitch Ratings

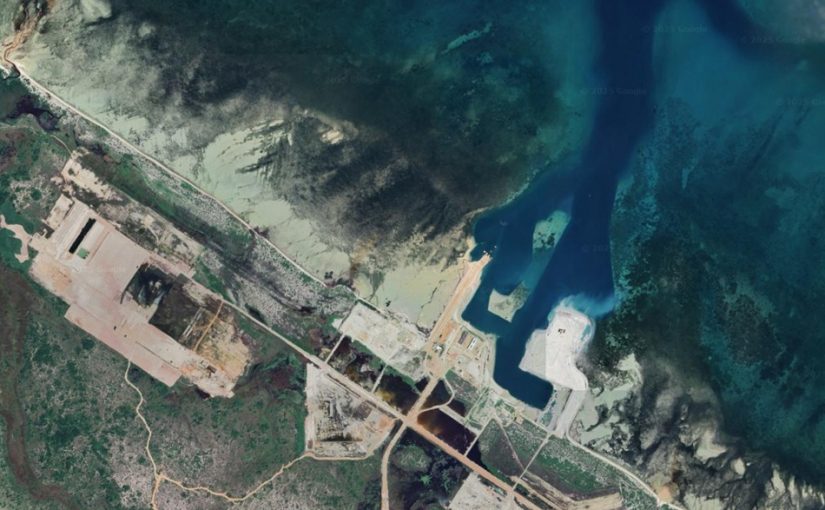

Image: Google Earth

The Export-Import Bank of the United States’ (EXIM) reported approval of a USD4.7 billion loan for TotalEnergies’ liquified natural gas (LNG) venture in Mozambique, if confirmed, will improve prospects for the resumption of the huge project, which could have multiple positive benefits for Mozambique over the medium term, says Fitch Ratings. However, we believe insecurity will continue to pose significant risks to completion of the development.

Mozambique’s Energy Minister, Estevão Pale, has said that EXIM’s board voted to approve the project, according to media reports, though the bank has yet to confirm this. If true, this would confirm the view we expressed when we downgraded Mozambique’s rating to ‘CCC’, from ‘CCC+’, in February 2025, that prospects for EXIM financing could improve under the new US administration. Other export credit agencies that have committed funds to the project were reported in late 2024 to be reviewing their financial pledges, in light of political developments in Mozambique.

Our baseline assumption remains that work on the TotalEnergies LNG project will resume in 2025, once the force majeure that has been in place since 2021 is lifted. TotalEnergies said in January, following the political unrest in Mozambique in late 2024, that the project would not be operational by 2029, but we believe a swift resumption of the project could allow some production and exports to begin around 2030.

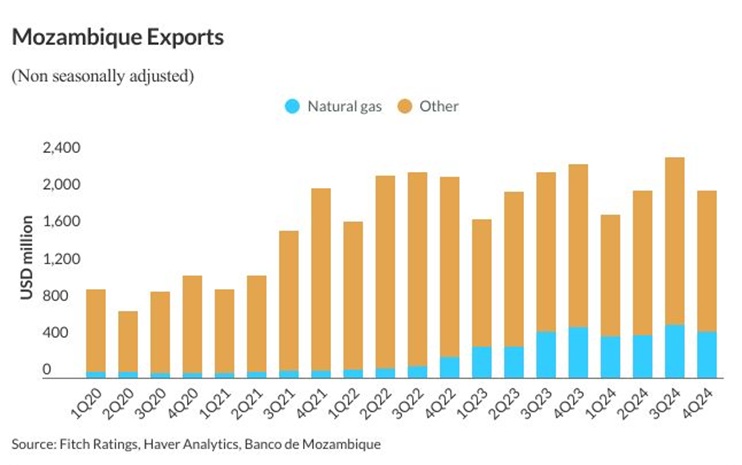

Successful development of the project would boost economic growth and provide important support to Mozambique’s export earnings and fiscal revenues. The first principal repayments of around USD250 million a year on Mozambique’s USD900 million Eurobond are due from 2028, ahead of its maturity in 2031, a period that may overlap with the start of production.

The resumption of construction on TotalEnergies’ LNG project could facilitate a final investment decision on a proposed USD30 billion LNG project by ExxonMobil. This project would be partly onshore and would contribute to economic growth during its construction stage. The production capacity of this project could be the largest so far in Mozambique, with a total capacity of 18 million tonnes per annum (mtpa), compared with 12.9 mtpa for the TotalEnergies project. Production is expected to start after 2030.

Eni has ordered a second floating facility (Coral North) for Area 4, likely to have the same capacity of 3.7mtpa as Coral South – the only LNG project in Mozambique currently at the production stage. Coral North will be offshore, and we expect its contribution to economic growth to begin only at the production stage, targeted for 2027-2028. Progress on Coral North is not related to TotalEnergies’ project.

Security threats and political instability could still pose risks to resumption of the TotalEnergies LNG project. Notably, our assumption that a Rwandan force, in place since 2021, will continue to support security in the area around the development is subject to uncertainty. EU funding for the force’s presence could be affected by political controversies. For example, the EU imposed restrictions on some members of the Rwanda Defence Force in March 2025 over alleged involvement in armed conflict in the Democratic Republic of the Congo. Further domestic political and social unrest in Mozambique could also retard progress on the project.

Development of the LNG sector will be important to Mozambique’s medium-term credit profile. However, we believe more important drivers of the sovereign rating in the near term will be the government’s access to external financing, its efforts to consolidate the public finances, and the prospects for an easing of domestic political and social tensions that support a normalisation of economic activity.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.