Mozambique: South32 Announcement - Mozal update | Unabridged

Triton Minerals identify $9million in alternative funding for Ancuabe pilot plant

Executive Director, Andrew Frazer. [Photo: Triton Minerals]

- Triton Minerals (TON) has identified A$9.76 million of alternative funding options advancing the modelling done by CPC Project Design at its Ancuabe Graphite Project

- The CPC Project Design was contacted to investigate the development and construction of the Commercial Pilot Plant (CPP) at its Mozambique based project

- The results of CPC’s work found a reduction of initial direct funding requirements of 13 to 22 per cent for A$44.6 to A$72.5 million capital expenditure estimate

- According to the announcement, TON contracted CPC to bring Ancuabe into production in the “short term, at a small scale, for low capex and on a commercially viable basis”

- Triton Minerals opened trading in the green at 3.5 cents a share

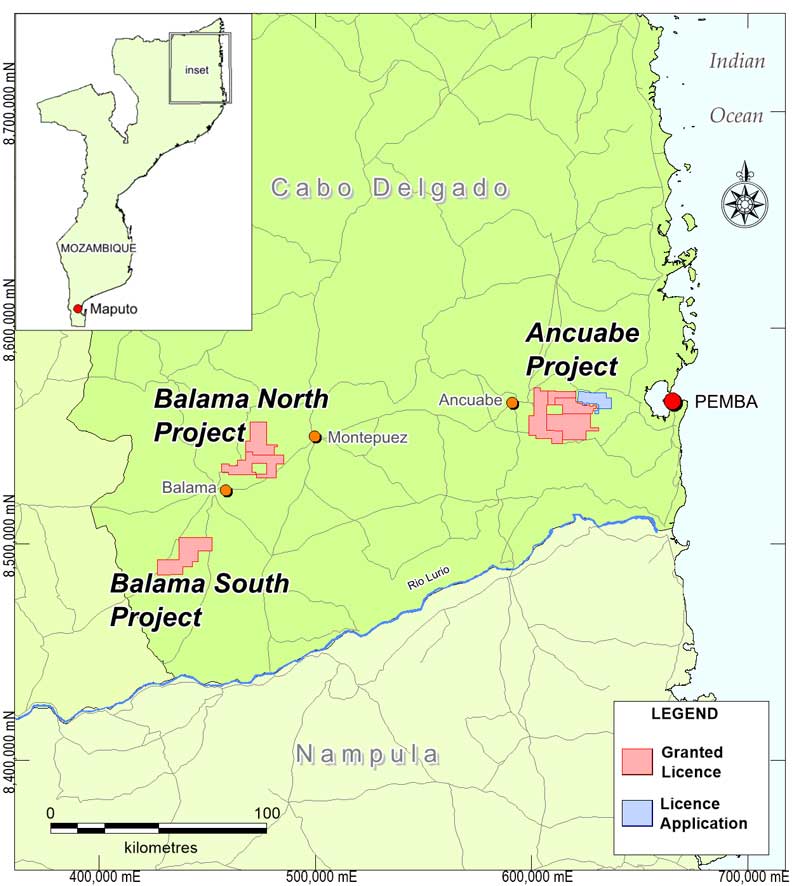

Triton Minerals (TON) has identified US$7 million (A$9.76 million) of alternative funding options through the advancement of the modelling done by CPC Project Design at its Ancuabe Graphite Project in northern Mozambique.

CPC Project Design was contracted to investigate the development and construction of the Commercial Pilot Plant (CPP) at theproject.

The results of CPC’s work found a reduction of initial direct funding requirements of 13 to 22 per cent for US$32 (A$44.6) to US$52 million (A$72.5 million) capital expenditure estimate.

According to the announcement, TON contracted CPC to bring Ancuabe into production in the “short term, at a small scale, for low capex and on a commercially viable basis”.

Looking ahead, TON has committed to share the results of its strategic review and the CPP desktop study with its shareholders.

TON also said it would continue finalising initial mine planning, additional off-take agreements, expressions of interests for alternative funding options and approvals.

“Once again I am pleased to be able to report both rapid and positive results that the Triton board and management have been able to deliver in consultation with CPC Project Design, who we have engaged to assist with the investigation into the development and construction of the CPP,” said Executive Director Andrew Frazer.

Triton Minerals shares were up almost 3 per cent at today’s open, trading at 3.5 cents.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.