High-cost loans, Trump turmoil hurting Africa, says G20 panel chief Trevor Manuel

Third time lucky? South Africa needs to plug $4.1 billion budget hole

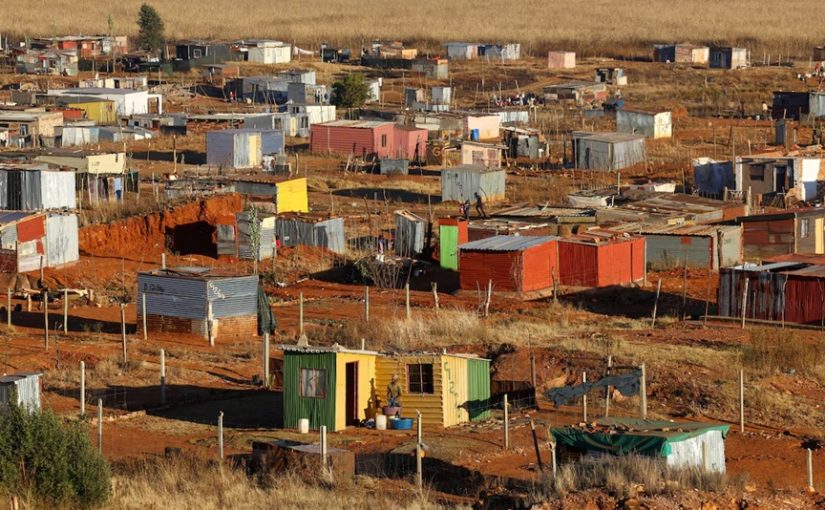

FILE - A man washes his clothes at an informal settlement for hundreds of South Africans who lack the means to get a proper home, located near Lenasia in Johannesburg, South Africa July 15, 2024. [File photo: Reuters/Siphiwe Sibeko]

Finance Minister Enoch Godongwana returns to parliament on May 21 for a third try at passing South Africa’s budget, after disputes with coalition partners over plans to increase tax scuppered two previous attempts.

Godongwana has to plug a 75 billion rand ($4.1 billion) revenue hole created by his decision to backtrack on raising value-added tax (VAT) while trying to stay the course on debt stabilisation.

Another failure to pass a budget could eventually see spending throttled on everything from frontline services to support for ailing state-owned companies like power utility Eskom.

What happened so far?

South Africa’s first two budget attempts collapsed under the kind of coalition turbulence Africa’s biggest economy had never witnessed until the African National Congress lost its parliamentary majority in last year’s election.

The budget set for Feb. 19 was yanked at the last minute when the Democratic Alliance – the second-largest party after the ANC in the broad multiparty government – balked at a two-percentage-point VAT hike.

When Godongwana returned on March 12 with a softer proposal to split the VAT hike into two 0.5-point moves over two years the DA took the fight to the courts.

Faced with legal proceedings and a potential break-up of the coalition, Godongwana scrapped the hike altogether leaving the 75 billion rand hole over three years.

Howl will Godongwana fill the gap?

Godongwana may rely on a mix of spending cuts and hopes that revenue collection will continue to outperform projections.

South Africa’s tax agency said in April that it had collected 8.8 billion rand more than forecast in the 2024/2025 fiscal year.

Jeffrey Schultz, BNP Paribas’ Central & Eastern Europe, Middle East and Africa chief economist, is optimistic the National Treasury will stick to its fiscal consolidation targets and ambition to maintain a primary budget surplus over the medium term.

Will bond issuances climb?

South Africa’s domestic fixed income market is a mainstay for foreign investors, who hold 25% of its 5.7 trillion rand in sovereign bonds and Treasury bills.

Any increase in amounts auctioned weekly in the domestic bond market would be marginal, said Kim Silberman, macro economist and fixed income strategist at Matrix Fund Managers.

“They pre-funded and are ahead of schedule. They are taking more cash into 2025/2026 than they had initially budgeted for,” said Silberman.

A modest rise from the current 3.75 billion rand of nominal bonds sold weekly would not unsettle investors, but it could put upward pressure on yields, Silberman said.

At this week’s government bond auction, primary dealers placed orders for almost four times the amount of securities on sale.

Will contingency reserves be tapped?

The Gold and Foreign Exchange Contingency Reserve Account captures valuation gains on South Africa’s these holdings and as of April 30 stood at 390 billion rand.

The government announced last year in February that it would start drawing from it, which it can do without parliamentary approval, to limit borrowing.

In April the central bank’s gold holdings jumped nearly 6% month-on-month to 245 billion rand, driven by higher prices of the precious metal.

Civil-society groups including the Institute for Economic Justice have urged the Treasury to use the contingency reserves instead of raising tax.

Where could things go wrong?

The government needs a simple majority to pass the budget, but further disagreements in the ruling coalition could derail a smooth vote.

Parliament has 16 working days from when the budget is tabled to approve the fiscal framework and revenue proposals, after which it has to pass two other pieces of legislation: the division of revenue bill and the appropriation bill.

The government can spend up to 45% of last year’s budget until parliament has passed the new budget. After that, spending would have to be cut.

The revamped fiscal framework, which sets overall limits for government spending, will be keenly watched by S&P Global Ratings, which has a positive outlook on South Africa and is scheduled to review its rating on Friday.

A credible outcome could secure the first rating upgrade for South Africa in two decades, while the opposite could raise future borrowing costs and dent investor appetite for local assets.

($1 = 18.2452 rand)

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.