Mozambique: Chibabava cement project fined 14 million meticais – Watch

Sub-Saharan Africa makes advances in real estate transparency

Bizz Community

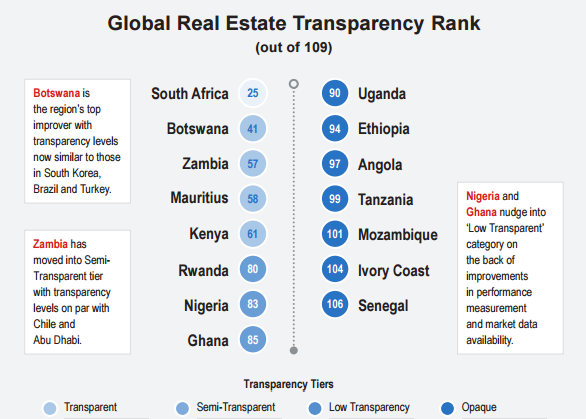

According to JLL and LaSalle Investment Management’s 2016 Global Real Estate Transparency Index (GRETI), while tangible improvements in transparency are being made, Sub-Saharan Africa is still some distance from competing equally with its counterparts in the EMEA region.

Sub-Saharan Africa makes advances in real estate transparencyEven further efforts are required to close the gap with other global regions.

“Sub-Saharan Africa continues to make advances in real estate transparency, but progress has been patchy with limited development in regulatory and legal reforms and enforcement,” comments Craig Hean, MD: Sub-Saharan Africa at JLL South Africa.

Improvements in regulatory oversight have great potential to enhance people’s lives and promote greater transparency within the region. High-profile failures of regulation such as building collapses have served to highlight that a lack of regulatory enforcement can have devastating consequences.

Hean notes “a growing recognition by governments across the region of the critical role transparent real estate markets can play in a dynamic economy”. He added, “The greater penetration by international real estate consultancies that are promoting professional standards and availability of market data has already begun to improve transparency in some areas.”

Key Sub-Saharan Africa highlights:

- Sub-Saharan Africa has continued to make advances in real estate transparency over the last two years, although progress has been more mixed than in 2014.

- Six markets (Botswana, Zambia, Ethiopia, Nigeria, Angola and Ghana) have recorded reasonable progress in transparency since the 2014 index.

- The improvement from Botswana, Zambia and Ethiopia has secured these countries a position on the ‘global top 10 improvers’ list.

- Despite these advances, the region has seen a slight deterioration in the legislative and operating environment which appears to have stalled in several markets, with two countries – South Africa and Mozambique – registering a noteworthy decline in overall score.

- South Africa, however, remains Sub-Saharan Africa’s most transparent market, supported by an active listed sector. It is the only country from the continent to feature in the ‘Transparent’ category.

- Technology is allowing some countries (Rwanda, Ghana, Kenya) to leapfrog the normal transparency evolution process by introducing innovative new ways of improving access to data or to faster, more reliable services.

- Complexities of implementing new regulatory structures and the impact of slowing commodity markets have stalled progress in certain areas.

Anthony Lewis, Head of Capital Markets, Sub-Saharan Africa comments, “One of the issues currently clouding the Sub-Saharan Africa market sentiment is currency and liquidity risk. There is significant uncertainty, especially in Nigeria, Angola and Mozambique and to a lesser extent Zambia, owing to acute US dollar illiquidity and lack of direction on monetary and central bank policies to alleviate this. This compounds transparency risks.”

The future of real estate transparency

Despite the slowing of momentum in some markets, there are continuing examples of tangible advances being made around the region. Increased accessibility to market information and scrutiny by international organisations, national governments and communities will continue to advance transparency in the region’s real estate markets.

On the flipside, there are as many examples that confirm that corrupt practices, poor corporate governance and failures in regulatory enforcement are resulting in serious consequences for society and hampering business activity and investment. Investors and tenants will bypass countries unable to address these shortcomings, and will gravitate instead to more transparent markets.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.