Mozambique: France to finance doubling of Maputo-South Africa railway line - Watch

Senegal joins Gabon, Mozambique in Africa trio on verge of debt distress

Image: Bloomberg

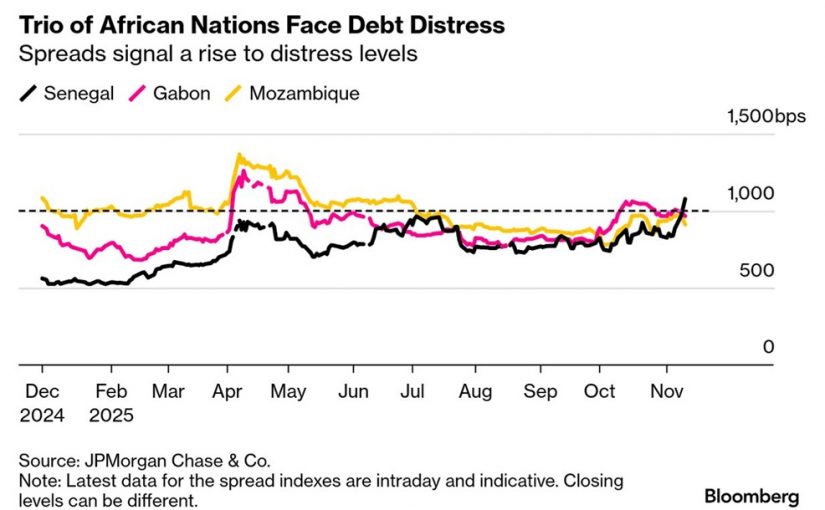

Senegalese bonds plunged to fresh record lows, placing the West African nation into debt-distress territory, according to a measure widely considered to be the threshold that locks countries out of global capital markets.

The sovereign risk premium on Senegal’s bonds over US Treasuries widened to 1 077 basis points on Wednesday — the highest on record, according to JPMorgan Chase & Co. data. That places the country among other African issuers whose debt is trading at or near 1 000 — seen as a marker of distress. Mozambique’s spread is at 965 basis points, and Gabon’s earlier this month traded above the threshold.

Senegalese bonds have weakened sharply this week after the International Monetary Fund ended a visit to the West African nation without an agreement on a new funding program, and the nation’s government signalled its opposition to any restructuring. The country’s previous $1.8 billion IMF package was frozen last year, after the government disclosed hidden debts estimated at $7 billion.

“It is clear that a significant probability of a debt restructuring is priced into Senegal’s bond and that this has increased again after the IMF statement on 6 November,” said Mark Bohlund, a senior credit analyst at REDD Intelligence. “This means that Senegal cannot access the eurobond market at the present.”

Prime Minister Ousmane Sonko at the weekend ruled out any debt restructuring to address the undisclosed borrowing. That triggered a selloff of Senega’s dollar debt on Monday that continued on Wednesday, with the yield on its 2031 bonds jumping 122 basis points to 16.87% by 12:19 pm in London. The rate has now increased almost 300 basis points since 7 November.

The IMF said Tuesday that it has explored several options with Senegal, and it was now up to the nation’s government to decide how to deal with “significant debt vulnerabilities.”

Senegal’s bonds are trading at “stressed levels,” Maciej Woznica, a fixed-income portfolio manager at Coeli Frontier Markets — a unit of Coeli Asset Management, which oversees about $4.8 billion — said on Tuesday. There’s a risk of “potentially more pain in short-dated bonds,” he said.

The extra yield that investors demand to hold African debt over similar-dated US Treasuries has fallen in recent years as nations from Ghana to Zambia pursued economic reforms. Almost a dozen countries have tapped the IMF since 2020 for $69 billion worth of funding.

Foreign investors ideally want to see a new IMF program for Senegal, but with realistic goals and parameters, according to Anthony Simond, investment director for emerging-market debt at London-based Abrdn Investments Ltd. He ruled out the risk of wider impact on the rest of the continent as a result of Senegal’s woes.

“Senegal is not a systemic problem,” Simond said. “Most countries in Africa are doing well: decent growth prospects, solid fiscals, reduced debt levels and increasing reserves.”

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.