Mozambique: Medium Term Debt Management strategy approved

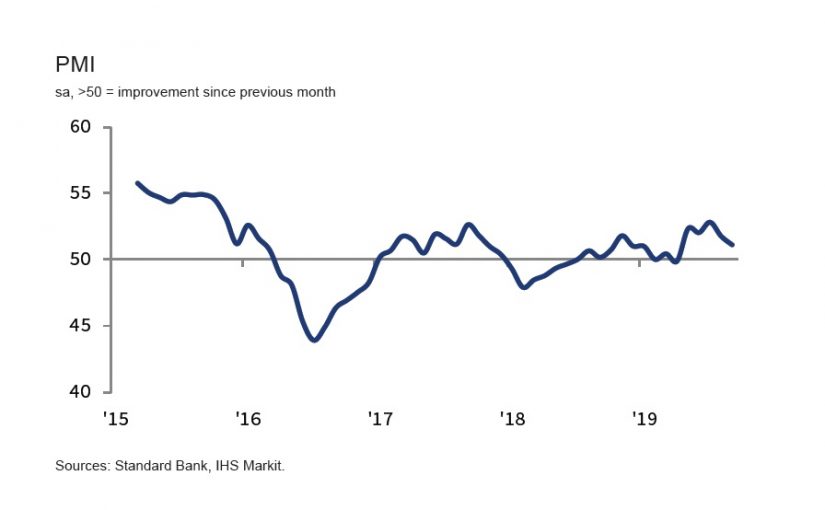

PMI falls to five-month low in September amid output growth slowdown | Standard Bank Mozambique PMI™ – Markit Economics

Source: Standard Bank Mozambique PMI™ - Markit Economics

Key findings

- Output rises fractionally…

- … despite solid growth in new orders

- Selling prices unchanged

Business conditions improved again in Mozambique over the course of September, albeit with the rate of improvement slowing amid only a fractional rise in business activity. Firms simultaneously kept selling charges unchanged in order to drive up new orders, which grew solidly over the month. Hiring activity increased modestly, while greater demand for inputs led to higher overall cost burdens. Meanwhile, future sentiment improved to a six-month high.

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI™). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

At 51.1 in September, down from 51.8 in August, the headline reading signalled a second consecutive slowdown in the rate of growth across the Mozambique private sector. It was the lowest reading in five months, and pointed to only a marginal improvement in operating conditions at the end of the third quarter.

This was in part down to a fractional increase in business activity, marking the weakest upturn since output began to rise just over a year ago. While firms continued to see new orders increase, a few halted activity due to problems with machinery. The ongoing election campaign also led to some cut-backs, according to anecdotal evidence.

At the same time, new order growth was solid and broadly in line with that seen in August. New branches and projects reportedly contributed to the expansion, while firms also saw an increase in sales to foreign clients.

However, the latest upturn in new orders came amid a halting of output price inflation, with September data recording no change in selling prices at Mozambican firms. At the same time, there was a slight acceleration in overall cost pressures due to higher demand for raw materials.

Firms meanwhile maintained a moderate rate of job creation at the end of the third quarter. Panellists found that this led to greater pressure on staff salaries, with the rate of inflation climbing to an eight-month high. Despite weaker output growth, companies were again able to reduce backlogs in September. This marked the third monthly contraction in work-in-hand in a row, although the latest reduction was marginal. Firms also retained a strong programme of purchasing activity, leading to the sharpest increase in stock levels since March 2018.

Lastly, sentiment towards the one-year outlook improved notably in September. Panellists were optimistic that business development and economic growth would spur further activity over the next 12 months, despite the recent slowdown.

Fáusio Mussá, Regional Economist at Standard Bank commented:

“We remain cautiously optimistic about the possibility of a robust recovery of the economy next year. While our GDP growth forecast of 3.7% y/y for 2020 published at the Standard Bank latest edition of the African Markets Revealed reflects the positive impact of LNG sector investments, it still translates into a subdued performance in the rest of the economy. The October 15th general elections will likely result in a slow start to 2020 as a new government takes time to be formed with the general government budget typically approved in December of the previous year, possibly going for parliamentary discussion towards the end of the first quarter of 2020.

“With fiscal pressures still likely to characterise the economy, it seems reasonable to expect that the reliance on the private sector to revive the economy has increased. Even if interest rates were to be lowered at a fastest pace, it will take some time before it generates a meaningful positive impact in the overall aggregate demand. Heavy reliance on subsistence agricultural output for the incomes of nearly 70% of the Mozambican households makes monetary easing less effective to shift GDP in the short-term.”

- Access PDF, full report HERE

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.