Mozambique: MIREME to hold 10th Coordinating Council with mineral and energy sector reforms in the ...

Petromoc in the red for third consecutive year – A Verdade

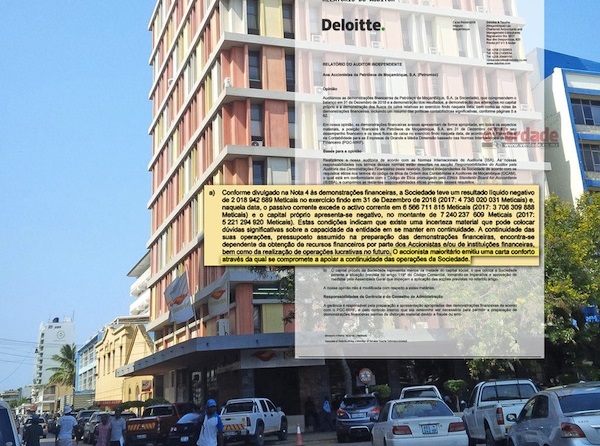

Photo: A Verdade

Petróleos de Moçambique (Petromoc), which reported losses of 2 billion meticais in 2018, is a company with negative equity since 2016, now to the tune of 7.2 billion meticais. It has bank debts of 13.7 billion meticais and is technically bankrupt for the third year in a row, a situation which it has told @Verdade, “will be remedied through ongoing structuring measures”.

The Mozambican government, which last year lent Petromoc 22 billion meticais to finance fuel imports, acknowledged the losses in a “comfort letter, where it pledges to support the continuity of the company’s operations”.

With a reduction in sales from 23.4 billion in 2017 to 20.9 billion in 2018, the state-owned oil company continues to run at a loss, as it has since 2015, though by two billion less than 2017’s 4.7 billion.

According to company financial statements which @Verdade has seen, the results carried doubled from 4.5 billion to 9.1 billion negative meticais, and current and non-current liabilities declined from 21.1 billion to 19.7 billion Meticais.

Non-current bank debt decreased from 11.9 billion to 10.6 billion meticais, while short-term borrowings increased from 2.5 billion to 3.2 billion meticais. Debt to suppliers decreased from 4.9 to 2.7 billion meticais, but other current liabilities increased from 4.7 to 7.6 billion meticais.

These accounts led Petromoc’s independent auditor to declare: “As disclosed in Note 4 to the financial statements, the Company had a negative result of 2,018,942,689 Meticais in the year ended on 31 December 2018 (2017: 4,736,020,031 Meticais) and, as of that date, current liabilities exceed current assets by 6,566,711,815 Meticais (2017: 3,708,309,888 Meticais) and shareholders’ equity is currently negative in 7,240,237,609 Meticais (2017: 5,221,294,920 Meticais).”

“The situation of technical bankruptcy will be remedied through ongoing structuring measures”

“These conditions indicate that there is material uncertainty that could cast significant doubt on the entity’s ability to maintain its continuity. The continuity of its operations, a presupposition made in the prologue to the financial statements, is dependent on the obtaining of financial resources by the shareholders and/or financial institutions, as well as the performance of lucrative operations in the future,” the auditor writes.

The auditor also point out that “the Company’s equity represents less than half of the Company’s capital, which places the Company in the situation described in article 119 of the Commercial Code”, which article refers to technical bankruptcy.

Contacted by @Verdade, Petromoc clarified by e-mail that “the situation of technical bankruptcy will be remedied through the structuring measures underway, with a view to the restructuring and revitalisation of the company”.

“In effect, the Company’s Management is implementing measures that will, on the one hand, increase sales volume, reduce operating costs and reduce investment, and, on the other hand, restructure bank and fiscal debt and through longer payment periods with suppliers of current goods and services, with the aim of improving the performance of the company and reversing the negative results situation, so as to allow the company’s net results to be reversed and to return to a balance that eliminates the spectrum of technical bankruptcy,” company financial administrator Mario Sitoe explains.

Government issued comfort letter of 7 billion and injected 22 billion for fuel imports

The auditor also states that: “The majority shareholder has issued a comfort letter under which it undertakes to support the continuity of the company’s operations”.

Petromoc’s majority shareholder, Sociedade Anónima, is the Mozambican state, which directly owns 60 percent of its capital and indirectly, through the State Administration of State Holdings (IGEPE), another 20 percent. @Verdade understands that the Government of Filipe Nyusi has taken of at least 7.2 billion meticais negative equity as domestic public debt.

In 2018, @Verdade revealed that, in order to ensure that Petromoc continued to carry out its activity of selling fuel, the government lent, through more internal public debt, 22 billion meticais in guarantees with the Banking Union and to serve as collateral for importing gasoline, diesel, LPG and light oil.

By Adérito Caldeira

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.