Portugal's Galp takes step to start arbitration over Mozambique capital gains tax dispute

Mozambique: TotalEnergies delays LNG production to 2026

FILE - Aerial view of Afungi. [File photo: O País]

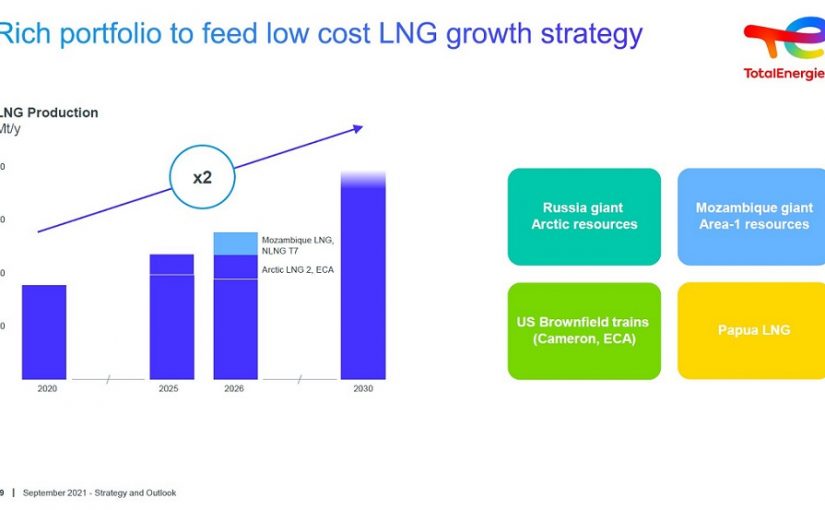

Total Energies has delayed the production of LNG in Area 1 which includes the development of the Golfinho and Atum natural gas fields and the construction of a two-train liquefaction plant with a total capacity of 13.1 million tons per annum in Mozambique to 2026 on its September 2021 strategy and outlook.

This follows the declaration of force majeure and the withdrawal of Mozambique LNG project personnel from the Afungi site as the security situation in the north of the Cabo Delgado province deteriorated.

The project which represents a total post-FID investment of $20B has already received financing amounting to $14.9B, the biggest ever in Africa, and includes direct and covered loans from 8 Export Credit Agencies (ECAs), 19 commercial bank facilities, and a loan from the African Development Bank.

Prior to this announcement the company had provided a forecast of 2024 for the commencement of the LNG project.

Total E&P Mozambique Area 1 Limitada, a wholly owned subsidiary of Total SE, operates Mozambique LNG with a 26.5% participating interest alongside ENH Rovuma Área Um, S.A. (15%), Mitsui E&P Mozambique Area1 Limited (20%), ONGC Videsh Rovuma Limited (10%), Beas Rovuma Energy Mozambique Limited (10%), BPRL Ventures Mozambique B.V. (10%), and PTTEP Mozambique Area 1 Limited (8.5%).

[You may read the full 2021 TotalEnergies’ Strategy & Outlook Presentation PDF HERE]

TotalEnergies now forecasting no LNG from Mozambique until 2026. It had previously forecast 2024, but even before declaring force majeure in April due to the insurgency many industry watchers had thought 2025 was more likelyhttps://t.co/NGKoDvo1xN

— Tom Wilson (@thomas_m_wilson) September 28, 2021

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.