Mozambique: Education in Inhambane pays over 200 million meticais in overtime

Mozambique: Progress has been made on the LNG project – Standard Bank

4:46 CAT | 23 Jul 2020

- Mozambique is now the beneficiary of the largest project financing deal on the continent, following last week’s completion of legal agreements for a financing package worth USD14.9bn, to fund the Liquified Natural Gas (LNG) project led by Total.

- LNG could potentially become the largest export earner by 2024, which thereby would support the balance of payments, accelerate economic growth over the medium-term and provide substantial gains for fiscal revenues.

- Despite all this, necessary reforms to achieve inclusive growth, will be pivotal, especially as the economy is still largely agrarian. The agriculture sub-sector accounts for over 20% of GDP and provides means of subsistence, to more than 70% of the population.

- Progress on the ease of doing business and investment promotion outside the resource sector, will remain critical for inclusive growth. Fighting poverty and improving standards of living are also seen as key strategies, to help resolve the country’s security challenges.

- Bear in mind that the LNG project with an estimated investment of USD20bn, is higher than Mozambique’s GDP, currently at around USD15bn. The Final Investment Decision (FID) for the project was taken in Jun19, following the approval of an enabling Decree Law in 2014, to develop natural gas resources discovered in 2010.

- The funding package seeks to support the development of Golfinho and Atum natural gas fields located in the offshore Area1 of the Rovuma Basin. Two liquification trains will be built onshore in the Afungi Peninsula located in the northern province of Cabo Delgado, to produce 12.9 million tonnes per annum (MTPA) of LNG.

- Last year’s FID took place after the Area1 partners secured long term off-take agreements to sell LNG to clients in Europe and Asia, with the first LNG cargo, expected by 2024. The Area1 contains reserves of more than 60 TCF (trillion cubic feet) of gas resources, out of which 18 TCF will be developed with the first two trains.

- In our view, it makes business sense to build more trains that allows profit maximization within the Decree Law and concession time frame. Thus, we suspect, another FID for the Area1 may be concluded before 2024, when the production from the first two trains commences.

- The consortium of the project financers includes several Export Credit Agencies (ECAs), Development Financial Institutions (DFIs) and commercial banks. Despite Mozambique’s hidden loans saga in 2016 which sent sovereign credit ratings to historic lows, project financiers were still not put off.

- Furthermore, financiers were also not discouraged by the Covid-19 pandemic uncertainty nor by challenges that arise from the project’s proximity to ISIS affiliated terrorist areas, which has resulted in several armed attacks and deaths since Oct 2017, closer to the Afungi LNG site.

- Mozambique also has large natural gas reserves in the deep-water offshore Area4 of the Rovuma Basin, estimated at 85 TCF, with discoveries in 2011 and 2014 in the Coral, Mamba and Agulha fields.

- Two LNG projects were approved by the Government of Mozambique (GOM) for the Area4. The first, Coral South FLNG (floating LNG) project led by ENI with an investment of more than USD10bn to produce 3.4 MTPA, was entirely sold to BP for over 20 years now. Construction of this project is already 60% complete and production could begin by 2022. The second, Rovuma LNG project with an investment of more than USD25bn, is led by ExxonMobil which announced the postponement of FID for the construction of two onshore LNG trains targeted for this year due to the Covid-19 pandemic.

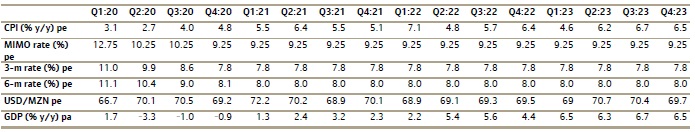

Figure 1: Medium-term economic growth base scenario

Source: Standard Bank

Show comments

Also read

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.