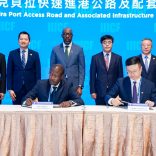

Mozambique: ANE and REVIMO sign agreements with China Road and Bridge Corporation

Mozambique: Most banks have high levels of non-performing loans – cenbank

File photo: O País

Banco Nacional de Investimento (BNI) was the Mozambican financial institution with the highest non-performing loan ratio at the end of 2023, but most are still above the 5% recommended by the central bank.

In the report on the Prudential and Economic-Financial Indicators for the last quarter of 2023, released on Thursday by Banco de Moçambique, BNI – which is on the central bank’s list of institutions with less than a thousand clients – closed the last quarter of the year with a non-performing loan (NPL) ratio of 43.98% of the total granted (43.79% in the previous quarter) and an NPL coverage ratio that fell to 70.26%.

The 15 or so commercial banks on the central bank’s list are followed by Ecobank, with an NPL ratio of 28.62%, and Moza Banco, with a ratio of 17.20%.

From the list released by the central bank, based on data provided by the financial institutions themselves, only United Bank for Africa (UBA), First National Bank (FNB), First Capital Bank (FCB) and Standard Bank have an NPL ratio lower than the recommended 5%, respectively 0.98%, 1.80%, 2.22% and 2.82%.

Millennium BIM, one of the country’s largest and led by Portugal’s BCP, saw its non-performing loans ratio fall in the last quarter to 4.55%.

The governor of the Bank of Mozambique, Rogério Lucas Zandamela, previously stated that the Mozambican banking sector is “solid and well capitalised” but warned that non-performing loans remain at high levels.

“The ratio of non-performing loans remains at relatively high levels,” he described, pointing out that it stood at 9.1% of the total last September, compared to 9.3% in the same month of the previous year.

“The national banking sector remains solid and well capitalised, with the solvency ratio standing at 24.0% in September this year [2023], corresponding to 12.0 percentage points above the regulatory minimum,” Zandamela pointed out in November.

Data from the central bank indicates that 15 commercial banks and 12 microbanks operate in Mozambique, as well as credit cooperatives and savings and credit organisations, among others.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.