Mozambique: FATF to visit in September to discuss leaving 'grey list'

Mozambique: Internal public debt spiral slows down for the first time since 2016

FILE - For illustration purposes only. [File photo: A Verkade]

After the record reached in the third quarter of 2023, the Mozambican government slowed the internal public debt spiral in the last quarter of the year, for the first time since 2016. However, domestic government debt already represents more than a third of Mozambique’s public debt and costs 4.2% of gross domestic product (GDP).

The new Medium-Term Domestic Debt Cost Reduction Strategy devised by Ernesto Max Tonela appears to be working. This strategy, among its eight measures, focuses on “discontinuing the approach to issuance by annual series and introducing an approach to issuing by reference lines (3, 5, 7 and 10 years), in order to achieve an optimal volume of liquidity that makes a secondary transactions market viable”, and “an increase in the volume of the long maturity Treasury Bond line (7-10 years)”.

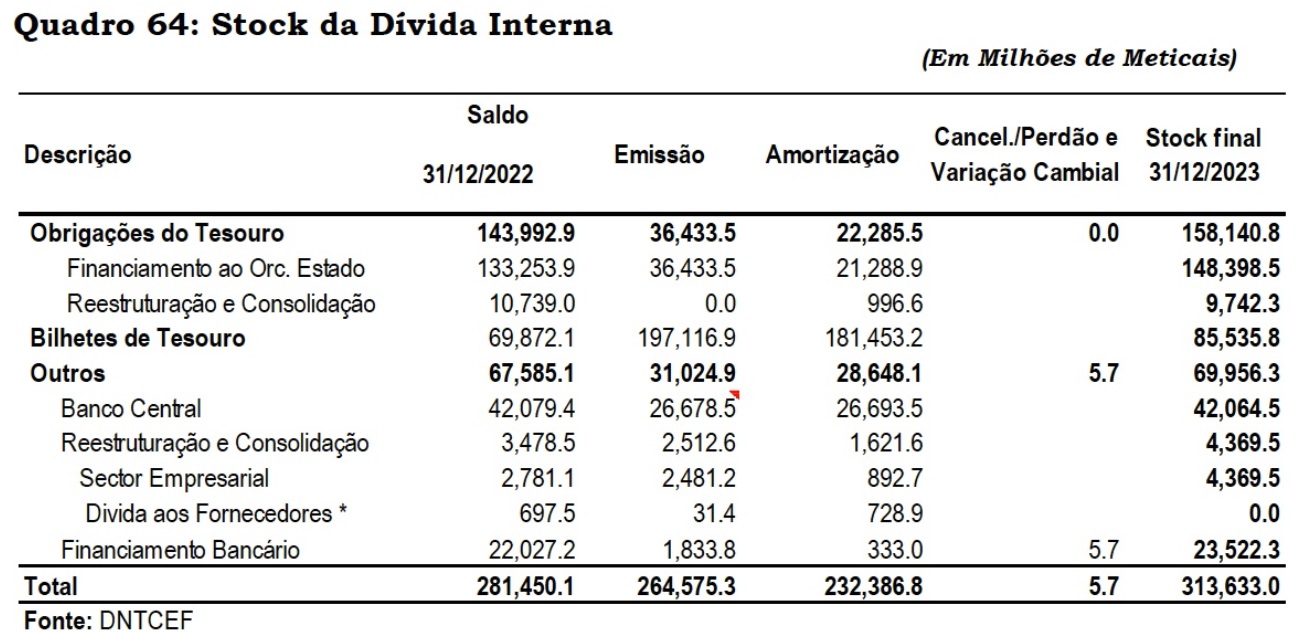

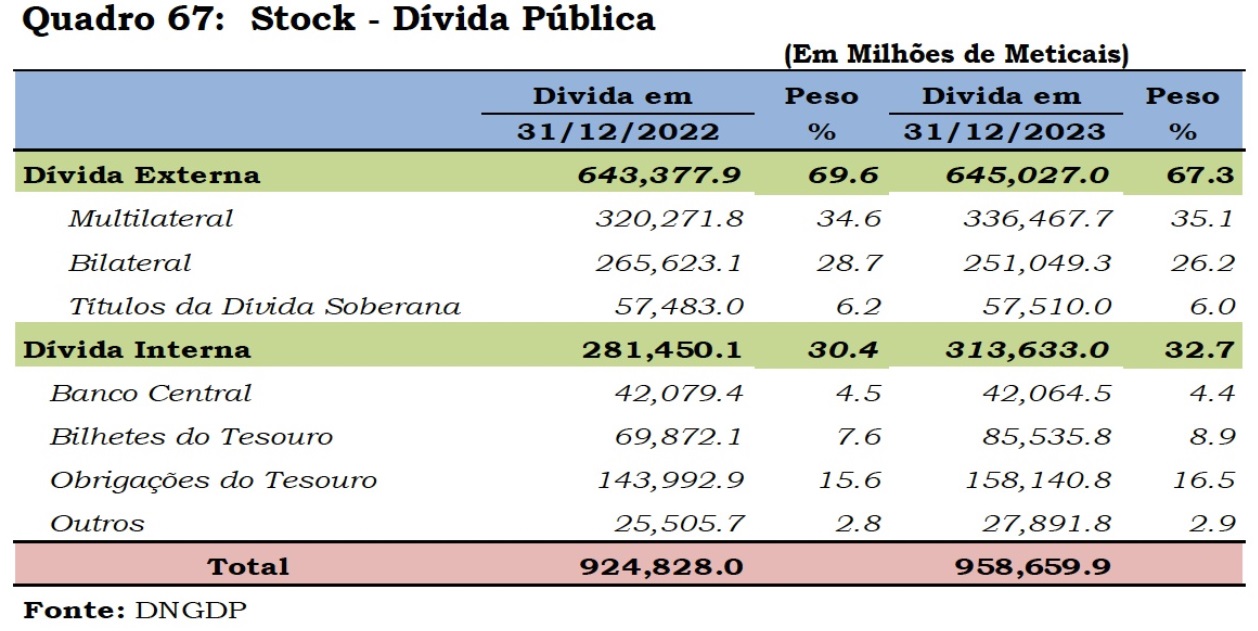

According to the 2023 Economic and Social Plan and State Budget, the Internal Public Debt Stock “reached a total of 313.6 billion meticais”, which is a reduction compared to the record of 328 billion meticais in the previous quarter.

“From January to December 2023, Treasury Bills were issued in the amount of 197.1 billion meticais, with replacements and amortisations carried out in the global value of 181.4 billion meticais, resulting in net financing of expenses in the amount of 15.6 billion meticais,” the document reveals, adding that, “during the year of 2023, bonds worth 36.4 billion meticais were issued”.

However, @Verdade found that, despite this reduction, the stock of Internal Public Debt represents 32.7 percent of all public debt in Mozambique, which in 2023 amounted to 958.65 billion meticais, and costs 54.16 billion meticais, that is, 4.2 percent of all the wealth expected to be produced in 2024.

Paradoxically, the spiral of internal public debt has not ended. To finance the 2024 State Budget, the government of Filipe Nyusi intends to increase domestic debt by 46.3 billion meticais, having obtained authorization from the Assembly of the Republic, with the approval of its latest Plan Economic and Social and State Budget, to “proceed with the advance financing” with the aim of “ensuring treasury liquidity at the beginning of the economic year”.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.