Mozambique: World Bank provides US$24 million for PDUNM housing project in Nampula, Cabo Delgado - ...

Mozambique: Inflation still likely to edge higher – Standard Bank

3:37 CAT | 11 Sep 2020

File photo: Lusa

- Mozambique’s annual inflation eased marginally to 2.75% y/y in Aug, from 2.8% y/y in Jul. On a m/m basis, inflation rose by 0.1% in Aug, which captures price increases across most sub-indices.

- Aug’s inflation print came in significantly below our expectations of 3.3% y/y. We suspect that this reflects a delay in the passthrough of previous currency weakness to inflation.

- Furthermore, food inflation continued to rise, reaching 7.68% y/y in Aug, from 7.52% y/y in Jul. Recall that since food products account for 30.7% of the CPI basket, food prices have a meaningful impact on the overall price level.

- The 12-m moving average for inflation maintained an upward trend at 2.92% y/y in Aug, from 2.86% y/y in Jul, due to base effects.

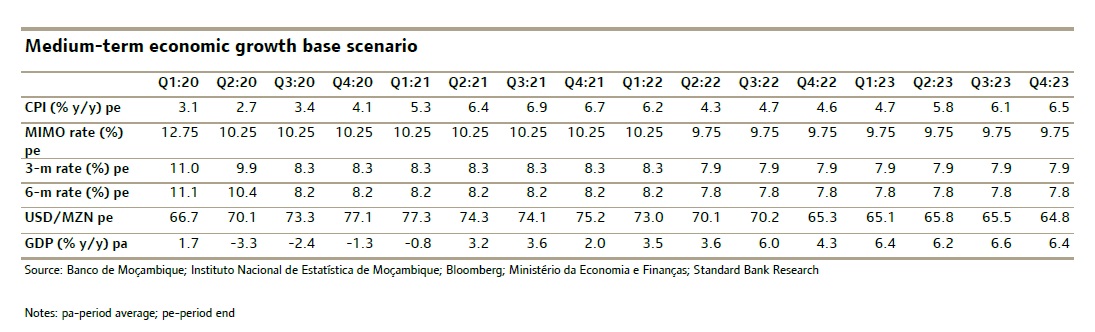

- We still see inflation rising gradually, closing this year at around 4.1% y/y and next year at 6.7% y/y. This corresponds to annual averages of 3.4% y/y and 6.1% y/y for 2020 and 2021 respectively.

- The negative impact of Covid-19 on the Balance of Payments (BOP) and increasing security challenges locally, continues to pressurise FX liquidity and the MZN. At the time of writing, the USD/MZN pair was trading at 71.78 with the ZAR/MZN at 4.27, which represents an annual depreciation of 15.9% y/y and 4.5% y/y respectively.

- Rising inflation risks stemming from currency depreciation probably motivated the Banco de Moçambique’s MPC to keep the MIMO rate unchanged at 10.25% since Jun.

- Of course, an escalation of security risks in the northern province of Cabo Delgado has negative implications for public finances and could aggravate existing BOP pressures, which may be another factor that could see the BOM act more prudently.

- Elevated security risks in Cabo Delgado could underline the expectation that there will be a diminished local content contribution to the implementation of the Liquified Natural Gas (LNG) projects, at least in the short term.

- We have updated our USD/MZN forecasts to reflect growing onshore FX liquidity pressures, and a deterioration in security conditions in Cabo Delgado. Hence, we now see the USD/MZN rising to 77.1 at year-end 2020, before easing to the 75 mark from mid- 2021.

- The Standard Bank Purchasing Managers Index (PMI) has remained below the 50-level since Mar, having printed at 46.1 in Aug, and 46.2 in Jul. The PMI indicates that economic conditions deteriorated further. Output prices is the only metric above the 50-mark, at 50.5 in Aug, which suggests possible price pressures on the rise driven by currency depreciation, since aggregate demand remains subdued.

- While the medium to long- term growth outlook remains positive, supported by the LNG projects, in the near-term we see the Covid-19 pandemic and security challenges depressing growth conditions. The economy is only likely to exit recession from Q2:21. Recall that the economy contracted by 3.3% y/y during Q2:20, after expanding by 1.7 y/y in Q1:20. In our base case we forecast a contraction of 1.3% y/y this year from 0.9% y/y that we had initially expected. We also expect a slower recovery next year with GDP growth reaching 2.0% y/y, revised lower from 2.3% y/y that we had anticipated earlier.

- You may access this Standard Bank Mozambique Flash Note HERE

Source: Standard Bank Mozambique

Show comments

Also read

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.