Mozambique: Savings deposits grow 15% in one year

Mozambique: IMF research suggests reassessing tax incentives – A Verdade

Image: Further Africa

As President Chapo was inaugurating his government – where the Economy, separated from Finance, began to oversee Industry – an IMF working paper suggested re-examining Filipe Nyusi’s National Industrialization Program (PRONAI) as well as reassessing tax exemptions to attract investment. “It is essential for the government and tax authorities to dedicate time to review the relevance of existing tax measures”.

“Mozambique’s generous tax incentives hurt domestic revenue mobilization (DRM),” notes the International Monetary Fund, asserting that, “international evidence demonstrates that tax incentives are often found to be redundant in attracting investment. As business surveys show, taxes are of second-order relevance for investment decisions in developing countries, while economic and political stability and other doing-business factors are critical decision aspects”.

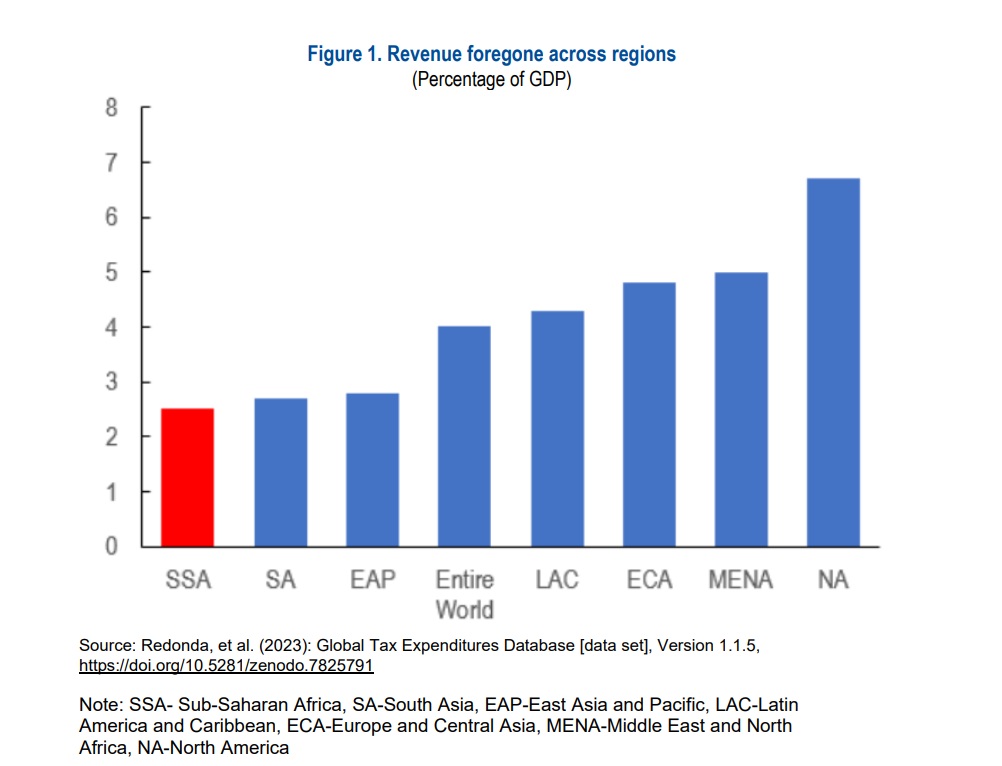

According to the most recent working paper ( ‘Is Tax Policy Costly Industrial Policy in Mozambique?‘ ) by the multilateral financial institution, “Mozambique has allocated significant fiscal resources through foregone tax revenues to support industrial policy measures. (…) While many cash-strapped countries implement tax policies as a quick way to attract foreign investors and boost domestic businesses, it’s vital that these measures are guided by a well-structured strategy, targeted effectively and supported by robust evidence”.

In the research, the financial institution points out that, “interestingly, businesses in Mozambique rank tax rates as a lesser concern among their operational challenges. Thus, it is essential for the government and tax authorities to dedicate time to review the relevance of existing tax measures. They should focus on protecting limited public resources by directing them toward areas that are likely to yield the greatest impact on socioeconomic development”.

About PRONAI , launched in 2021 by President Nyusi to increase national industrial production, use more local raw materials, stimulate production and reduce raw exports,, the IMF economists write: “The overarching objective of the [industrial] strategy is to enhance the competitiveness of local enterprises. However, although the industrial policy is underpinned by favourable domestic and international economic conditions, it lacks a robust evidence-based strategy critical for driving its success. While the strategy encompasses a range of operational mechanisms, it inadequately addresses a comprehensive tax collection strategy in the context of recent liquefied natural gas (LNG) discoveries and does not sufficiently articulate measures to attract foreign direct investment”

“The current growth strategy presents a trilemma involving competing objectives: protecting national firms while attracting FDI through industrial policy, maintaining financial and fiscal stability, and promoting economic growth,” which is why the IMF recommends that Mozambique “rectify coordination mismatches observed among public entities, particularly the potential misalignment between industrial and fiscal policy”.

“Adjusting industrial policy strategies to align with new economic dynamics is essential. Furthermore, recognizing that national development includes the provision of quality public services., it is vital to integrate development and industrial strategies with tax policy instruments to achieve a balance between attracting investment and ensuring financial and fiscal stability,” reads the Working Paper by Santos Bila, Utkarsh Kumar, and Alexis Meyer-Cirkel .

It should be noted that, as the researchers point out, “MF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate”.

“The views expressed in IMF Working Papers are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management,,” they stress.

“This paper analyses the use of tax policy as industrial policy in Mozambique. Despite significant foregone tax revenue due to industrial policy in the form of tax incentives, the effectiveness of Mozambique’s tax policy remains questionable due to insufficient data and unclear public policy strategy. Through an examination of macro data, tax reports, and data from World Bank Enterprise Surveys, the note underscores the need for a thorough reassessment of existing tax measures. It advocates for a more strategic, targeted and evidence-based design of tax incentives that deliver on industrial policy goals.,” reads the summary.

By Adérito Caldeira

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.