Mozambique: Task force created to assess reduced external funding in health

Mozambique hikes key rate to near four-year high – Bloomberg

File photo: DW

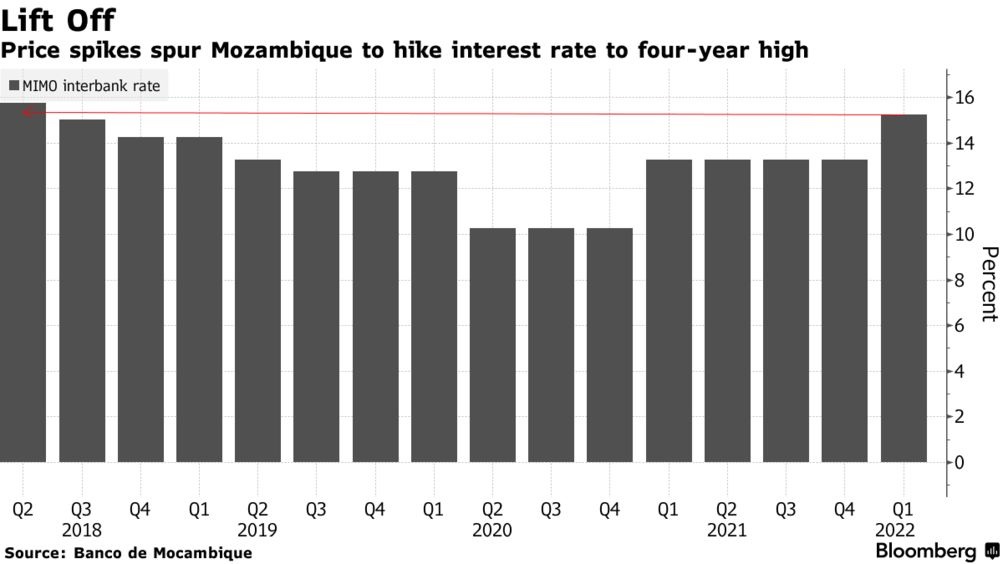

- Mozambique’s central bank increased its key interest rate to a near four-year high, citing rising prices resulting from Russia’s invasion of Ukraine and the effects of tropical cyclones that struck the country earlier this year.

The Banco de Moçambique raised the rate to 15.25% from 13.25%, Governor Rogerio Zandamela told reporters Wednesday in Maputo, the capital. That’s the first increase since last January and takes the rate to the highest since June 2018, when it was 15.75%.

While annual inflation slowed in February, fuel costs have since increased to a record fanned by sanctions on Russia and the war in Ukraine, heightening risks of a surge in consumer prices in coming months. The net wheat importer also faces price pressures on food due to severe cyclones that devastated agricultural fields and a spike in the cost of the grain since the war started. Ukraine and Russia ship more than a quarter of the world’s wheat, and the fighting has halted shipments.

The MPC sees inflation accelerating in the short to medium term and revised its forecasts upward, Zandamela said without providing details.

Fitch Ratings said this month it expects inflation to average 8.5% this year on the back of higher oil and food prices.

The monetary authority had room to move as the pace of recovery in the economy has gained momentum. Mozambique’s gross domestic product is projected to expand by 5.3% this year, according to an October forecast from the International Monetary Fund. That’s more than double the growth rate forecast for 2021, with output set to rebound from a pandemic-induced slump and natural gas exports due to start in the second-half of the year.

Mozambique’s move comes as emerging markets from Egypt to Ghana raise borrowing costs to curb runaway inflation and attract investors seeking higher yields due to the war in Ukraine and the U.S. Federal Reserve pivoting toward more aggressive rate hikes to fend off mounting price pressures.

The yield on Mozambique’s dollar bond maturing in 2031 fell 5 basis points to 10.59% at 2.54 p.m. in London.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.