Mozambique: Government holds public consultation on creation of the General Inspectorate of the ...

Mozambique: Government borrowing speeding up – central bank

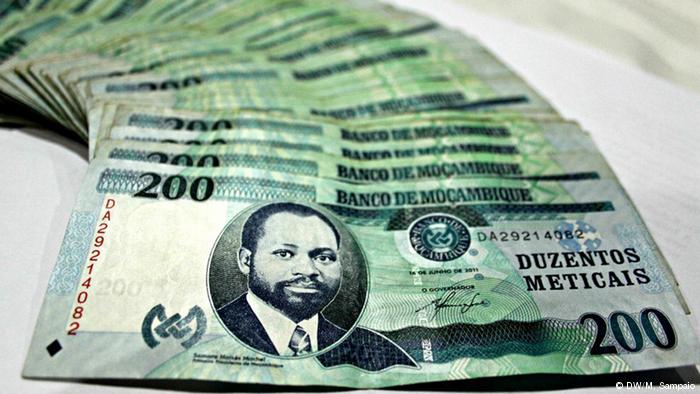

File photo: DW

The Bank of Mozambique points to an “accelerating trend” in domestic public borrowing, pointing out that between December 2022 and last September, it grew, in absolute terms, by 45.9 billion meticais (€681.7 million).

“The trend of accelerating domestic public borrowing continues,” according to a central bank report on the economic situation, to which Lusa had access on Monday, which puts this total borrowing up to September at more than 321.09 billion meticais (€4.76 billion).

It is also worth highlighting the use of financing from the Bank of Mozambique and Treasury bond issues.

“In the short term, this scenario is expected to continue, given the limited collection of tax revenues, despite the improvement in disbursements of external resources by international partners,” the report also said.

On 19 September, Mozambique auctioned another 3.509 billion meticais (€51.2 million) in a single issue of Treasury Bonds through the Mozambique Stock Exchange (BVM), with demand exceeding supply.

At issue was an operation for direct subscription by Specialised Treasury Bond Operators (OEOT) of up to 3.509 billion meticais – which was completely filled – relating to the eighth series of 2023 Treasury Bonds, the first operation of its kind in September.

The overall demand for this issue was 4.369 billion meticais (€63.8 million), “with a demand to supply ratio of 124.51%, with a minimum rate of 16.000% and a maximum of 21.000%”, in an operation with a maturity of 10 years and a fixed interest rate of 16%.

Since January, Mozambique has auctioned 28.91 billion meticais (€422.3 million) in Treasury Bonds through the stock exchange, and is still allowed to issue a further 7.738 billion meticais (€113 million) until the end of the year.

According to decree 14/2023, issued by the Ministry of Economy and Finance on 18 January, the issue of Treasury Bonds – public debt issued with longer maturities – for this year provides for an overall limit of 36.648 billion meticais (€526.4 million), preferably in two monthly issues, until 5 December.

Data from the Mozambique Stock Exchange compiled by Lusa indicates that 14 issues have already been made – including reopenings of scheduled issues – in 2023, with maturities of up to 10 years and interest ranging from 17% to 19%, thus reaching almost 80% of the legal limit for Treasury Bond debt for this year.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.