Mozambique: 'Guias de Trânsito' to reduce road deaths - report

Mozambique: Further mild deterioration in business conditions in December – Standard Bank’s PMI Index

File photo: TVM

- Output falls at slowest pace since March

- New orders decrease modestly, but rate quickens

- Employment growth strengthens to ten-month high

Data were collected 4-18 December 2020.

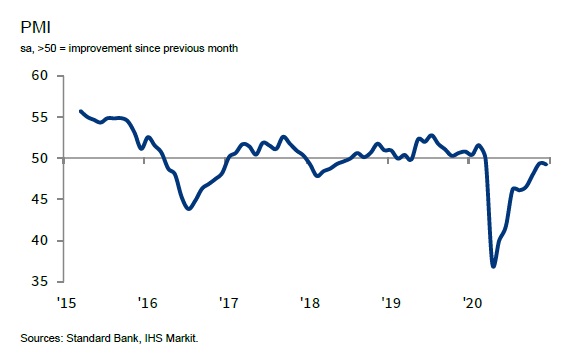

The Mozambique PMI™ edged down in the final survey release of 2020, as incoming new business declined at a stronger rate for the first time since April. Nevertheless, more positive signs were recorded for output, which contracted at the slowest pace since March, and employment which grew at the most marked rate for ten months amid building optimism for the future.

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

At 49.3 in December, the headline PMI was down fractionally from 49.4 in November, marking only the second decrease in the index for eight months. That said, the reading signalled only a slight deterioration in the health of the private sector economy, as the impact of the coronavirus disease 2019 (COVID-19) pandemic remained weaker than seen earlier in the year.

The headline index masked slight variations in direction of some of the key indicators in December. On the downside, new orders at Mozambican firms decreased at a quicker pace than in November, amid a fall in client numbers and reports that export goods took longer to arrive at destinations. That said, the fall in demand remained modest.

By contrast, there were upticks in both the output and employment indices in December. Latest data signalled the slowest decrease in business activity since March, while job numbers rose at the strongest pace for ten months. Notably, several panellists reported concerted efforts to build back their workforces after the COVID-19 downturn.

These efforts were in part driven by an improvement in business expectations in December, amid increased hopes of a global recovery due to the development of COVID-19 vaccines. Optimism strengthened for the second month running, although it remained below the series average.

Meanwhile, a fall in new orders led firms to reduce their purchasing activity for the first time in three months in December. This resulted in a further reduction in stocks, and helped suppliers shorten delivery times at the fastest rate since March.

On the price front, Mozambican firms indicated a renewed increase in cost pressures in December, the first recorded for nine months. Anecdotal evidence largely related the rise to a weaker exchange rate against the US dollar. Staff wages also rose, but at a slower rate than in November.

Currency weakness led firms to pass higher costs on to clients, shown by a renewed increase in selling charges at the end of the year. That said, the overall uptick was only marginal.

Comment

Fáusio Mussá, Chief Economist – Mozambique at Standard Bank commented:

“Following a challenging year in 2020, the outlook for 2021 remains negatively affected by Covid-19 uncertainty, security challenges, a fragile fiscal position and limited space for monetary policy support. As a result, we see a slow growth recovery. Most likely the economy will only exit recession during Q2:21, with GDP growth expected to average 2% y/y for the whole year.

“Even considering expectations that the rise in inflation in 2021 will likely remain modest towards an average of 5.6% y/y, supported by subdued aggregate demand, we noticed an increase in upside risks. Continued Metical depreciation brings inflation risks. At the time of writing, the USD/MZN was trading at the level of 74.8, up by 21.7% y/y, still below our expected short-term peak level of 77.3. The ZAR/MZN was trading at 5.04, up by 15.3% y/y with the EUR/MZN trading at 91.04, rising by 32.1% y/y.

“The Central Bank reported at mid-December that the foreign exchange market enjoys adequate levels of liquidity. The banking system purchased USD5.01bn in the domestic market, against sales of USD4.95bn, resulting in net purchases of USD72m. This aggregate data does not capture the weekly supply demand imbalances the foreign exchange market experiences, which continued to drive Metical depreciation.

“We see Central Bank maintaining foreign exchange rate flexibility as a tool to help protect foreign exchange reserves. Gross foreign exchange reserves remained relatively stable since the end of 2019, with a gross balance close to USD3.9bn, which represents near 7 months of import cover, excluding the large projects imports.”

Methodology

The Standard Bank Mozambique PMI™ is compiled by IHS Markit from responses to questionnaires sent to purchasing managers in a panel of around 400 private sector companies. The panel is stratified by detailed sector and company workforce size, based on contributions to GDP. The sectors covered by the survey include agriculture, mining, manufacturing, construction, wholesale, retail and services. Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

The headline figure is the Purchasing Managers’ Index™ (PMI). The PMI is a weighted average of the following five indices: New Orders (30%), Output (25%), Employment (20%), Suppliers’ Delivery Times (15%) and Stocks of Purchases (10%). For the PMI calculation the Suppliers’ Delivery Times Index is inverted so that it moves in a comparable direction to the other indices.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series. December data were collected 4-18 December 2020.

For further information on the PMI survey methodology, please contact [email protected].

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and also for key regions including the eurozone. They are the most closely watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.