Mozambique: Savings deposits hit record high in 2024, up 12.5% – central bank

Mozambique: FDI plummets again, to lowest level since 2010 – A Verdade

Image: A Verdade

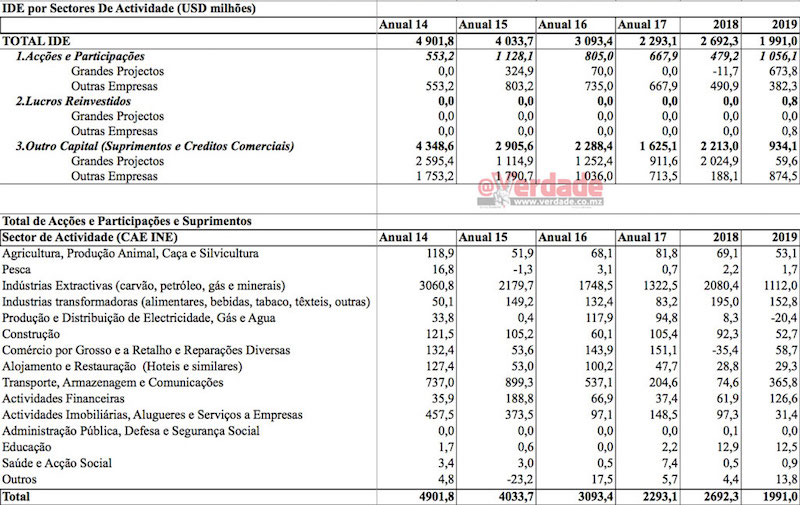

Although 2019 saw the biggest private investment decision in Mozambique’s – and Africa’s – history, the total of foreign direct investment (FDI) in the country again fell, to its lowest value since 2010.

More than half of 2019 FDI was made by Vale and partners in the Northern Development Corridor, while natural gas megaprojects counted for only US$898 million.

Professor Carlos Nuno Castel-Branco explained to @Verdade that the final investment decision in Area 1 [Rovuma Basin] on the eve of the general elections aimed to “stabilise the (economic) situation and give the necessary space to strengthen the position of (Filipe) Nyusi and the Frelimo party” .

After a small growth to US$2.7 billion dollars in 2018 from US$2.3 billion in 2017, last year’s trade balance shows that FDI stood at only US$1.9 billion, the lowest figure since 2010, and before the boom in the extractive industry, when Mozambique saw only US$1 billion in foreign direct investment.

Figures from the Bank of Mozambique indicate that, last year, megaprojects continue to be the main source of foreign direct investment, bringing in US$1.1 billion. However, US$979.8 million was directed to the coal sector and originated with Vale Mozambique and its partners, which use the United Arab Emirates as a tax domicile.

Although the Cabo Delgado Area 1 Dolphin and Tuna fields consortium signed final investment decision documents worth US$22 billion in 2019, investments in natural gas projects in the Rovuma Basin contributed only US$1.2 billion, largely made by ENI and ExxonMobil, which are exploring fields in Area 4.

In a recent interview with @Verdade, Professor Castel-Branco explained that “final investment decisions are not really investments: they are decisions that investment will take place”.

“On the one hand they create the impression that we are recovering, and this can help attract small and medium capital for small things because, if the investment decision was made, they will need electrical wires, rolling bearings and other small things. So their expectation is that when making (investment) decisions, this will stabilise the (economic) situation and give the necessary space to strengthen the position of (Filipe) Nyusi and the Frelimo party,” he explained.

2019 marked by divestments in the electricity, gas and water production and distribution sector

Castel-Branco, a researcher from the Institute of Social and Economic Studies (IESE), warned that final investment decisions were “a type of bubble expectation, a false expectation, which will be highly inflationary, and this will affect people’s well-being”.

Corroborating the perspective of Castel-Branco and other Mozambican academics who count the Bank of Mozambique among the “apostles of doom”, the institution has revised its outlook for inflation in the medium term upwards.

The second-largest target for FDI in 2019 was transportation, storage and communications with US$365 million, followed by manufacturing (food, beverages, tobacco, textiles, others), with US$152 million.

The agriculture, animal production, hunting and forestry sector, which is considered the backbone of development in Mozambique, continues to receive very little investment – currently US$53 million. Production and electricity, gas and water distribution in 2019 saw FDI fall by US$20 million.

By Adérito Caldeira

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.