Mozambique: $1.1B raised to renovate country's main highway, out of a total $3.5B needed

Mozambique: FDI falls by 26% on debt crisis, UN says

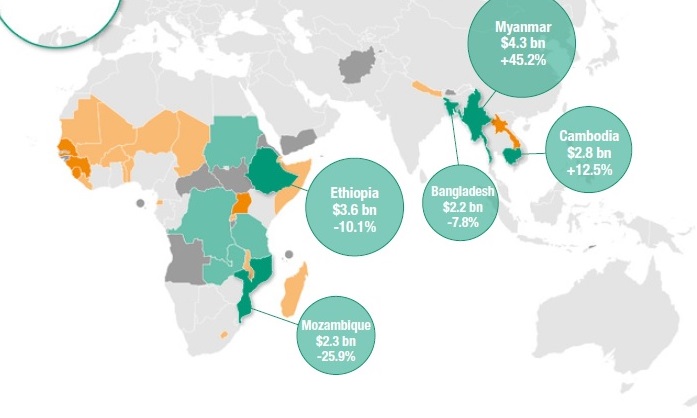

Picture: WIR 2018, UNCTAD

Foreign investment in Mozambique fell 26% to US$2.3 billion due to austerity and the country’s debt crisis, according to the World Investment Report, of the United Nations Conference on Trade and Development (UNCTAD).

“FDI into Mozambique contracted severely,down 26 per cent to $2.3 billion, amid austerity and debt defaults.,” said the document released on Thursday in Geneva, which focuses on the importance of the gas sector for the future of the country.

The report’s section on Mozambique said the long-term prospects rely on the country’s liquefied natural gas potential being exploited and profits reinvested to advance domestic development.

The coal sector, which is important to the country’s exports attracted investor interest from a consortium of Chinese, British and South African firms, but the project is in its early stages, UNCTAD said. It also noted thatin the face of serious macroeconomic challenges, the recovery of MNE [ multinational enterprises] operations in mining alone was not enough to turn around FDI flows across sectors.

The UNCTAD report found that the decline in FDI flows to Africa was mainly due to weak oil prices and pointed out that harmful ongoing macroeconomic effects from the commodity bust saw flows contract in Egypt, Mozambique, the Congo, Nigeria, and Angola.

FDI flows to Africa slumped to $42 billion in 2017, a 21 per cent decline from 2016, reads the report.

Meanwhile, global FDI dropped by 23% last year to US$1.43 trillion, according the analysis released on Thursday by UNCTAD.

- You may access UNCTAD’s World Investment Report 2018 HERE

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.