Weather Alert: Strong winds for southern Mozambique

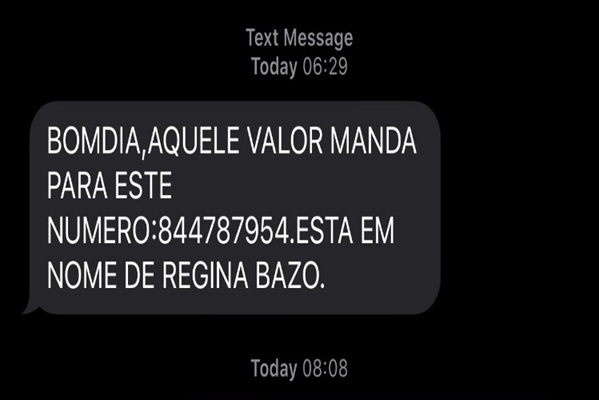

Mozambique: Electronic scams continue throughout the country

Image: Folha de Maputo

There has been a growing wave of virtual scams perpetrated by unknown individuals in recent years, with a particular focus on messages with fraudulent content about prizes and money transfers.

These attempted frauds have often had the desired results – a concern not only for mobile phone users, but also keeps the authorities responsible for regulating telecommunications in the country, such as the National Institute of Communications of Mozambique (INCM).

A quick review of data recently released by the INCM indicates that, in 2024, more than 500 cases of fraud were recorded, and for the current year, more than 100 reports have been filed.

Regarding the financial scams that have caused the most victims, the INCM, in coordination with the Attorney General’s Office (PGR), mobile phone operators and bank branches, launched a platform where reports can be made so that those involved have access in real time with a view to investigating, locating and holding the perpetrators accountable.

In an interview with Folha de Maputo, INCM spokesperson Adilson Gomes revealed that there is no specific law that defines who can or cannot send messages, fraudulent or abusive, but the user can decide for themselves to block or report them via the existing platform.

“Last year, there were 500 cases and this year, on the reporting platform alone, we have more than 100 related to various situations. In the telecommunications sector, there are all the conditions to identify and locate subscribers, but the state never uses this capacity arbitrarily and, of its own free will, the citizen who felt offended should seek the authorities to present the content and, based on this complaint, the state has all the mechanisms to pursue and hold the sender accountable,” Gomes explains.

Gomes says Mozambique has around 21 million active telecommunications subscribers, and acknowledges that the state’s biggest challenge is related to growing fraud schemes. “As the sector has to organize itself technologically to respond to these challenges, it knows that fraudsters are becoming more sophisticated, but it is a challenge that we know that as a sector we must always be prepared to face,” he says.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.