Mozambique: INAMI presents bill on mining as part of public consultation - Watch

Mozambique debt crisis does not prevent investments in gas – BMI

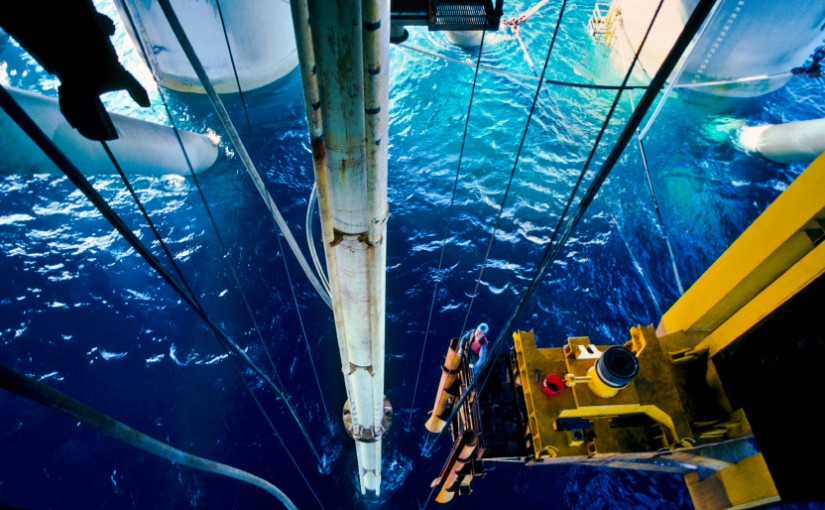

File photo

The UK Business Monitor International (BMI) research agency says that the financial and economic crisis in Mozambique will not influence the major oil companies’ decisions about investment in the exploitation of the country’s natural resources.

According to the latest BMI report on oil and gas in Mozambique, which Lusa had access to, the experts of this Fitch group consultancy say that, although public finances are under pressure, large multinationals have the capacity to maintain their commitment to the country, citing ENI’s Coral South final investment decision as an example.

“The Coral project is not at risk due to the escalation of the financial crisis in Mozambique,” the analysis reads, going on to say that investment promoters could even cover that part of the project which is supposed to be financed by the National Hydrocarbons Company [ENH], the local energy regulator, which holds a 10 percent stake.

“The ability of the government to finance its share of the project is a cause for concern,” they say, while noting, however, that “the financial and technical capacity of other shareholders is significant and there is ample scope to execute ENI’s financial commitments in order to make the project move forward” if that proves necessary.

The consortium, led by Italian ENI with a 50 percent stake, CNPC with 20 percent, and KOGAS and Galp with 10 percent each, signalled its final investment decision in the Coral FLNG Rovuma basin project at the end of last year.

The report also notes that Fitch has downgraded Mozambique’s rating from B to CCC, in line with other negative rating agency reviews, which consider that the country is in default because it has not paid the first repayment instalment of public debt issued in April last year.

In addition, BMI notes that “risk appetite in the oil and gas sector has generally been diminished by the collapse in oil prices since the summer of 2014, which, added to the downgrades in the rating, may significantly increase financing costs”.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.