Mozambique: Álvaro Massingue elected Regional Director for Africa of the International Chamber of ...

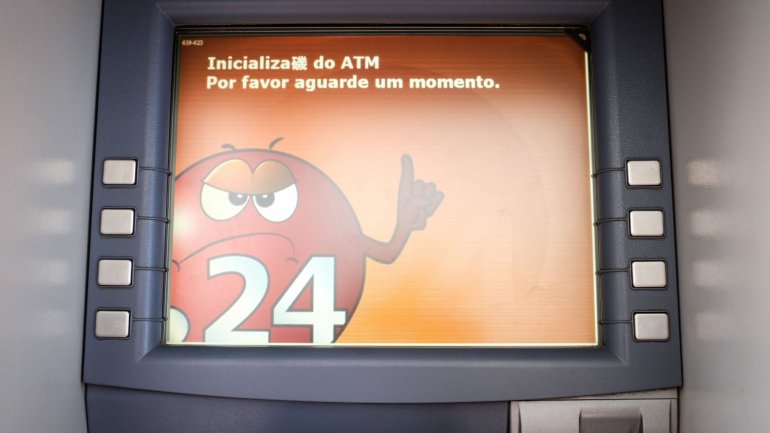

Mozambique: ATM, bank card blackout ‘due to failure to pay’ – Portuguese software provider

Picture: Lusa

The blackout of automatic teller and card operations of most Mozambican banks since Friday, results from a failure to pay sums due and other breaches on the part of Simo, the company that runs the network, according to Bizfirst, a Portuguese firm that supplied technology for it.

“Simo/InterBancos unlawfully used Bizfirst software for more than two years without ever paying,” the company said in a communique, adding that it “has worked hard to reach a deal,” including a series of price cuts,” but Simo never accepted any agreement”.

The Portuguese firm complains of non-response on the part of Simo, whose majority shareholder is Mozambique’s central bank, even after warnings it says were issued on November 7 and 16 about a stoppage to services if nothing were done.

“The stoppage of SIMO network’s services occurred with full knowledge of the executive committee of the company and of InterBancos, which did nothing to avoid it, neither a phone call, email or letter, nor any contact with the administration of Bizfirst [being made],” the communique reads.

Bizfirst indicates in the same statement that Simo/Interbancos practised “illegal and unauthorised use of the software, without signed contracts and without any payment made. It was, it states, “the conduct of these entities” which caused the occurrence of “this unwanted situation”.

Bizfirst’s response comes after Simo announcing yesterday at a press conference that the company supplying the IT solution was imposing unsustainable conditions, some even damaging to state sovereignty.

Gertrudes Tovela, chair of Simo’s board of directors and also a member of the Board of Directors of the Bank of Mozambique, said that the company was being subjected to “blackmail”: demanding that certain conditions be met, or else the service would be cut off.

Bizfirst denies this in yesterday’s communique, calling the statements “serious” and announcing that it would lodge complaints for slander, defamation and offence to a legal entity.

The blackout “is unique and regrettably attributable to the relevant entities” in Mozambique, it adds.

Bizfirst has provided and supported the platform for the operation of, first, the InterBancos network, since 14 years ago, and was contacted following the creation of the Simo, which took over from that company, leading to the signing of a memorandum of understanding in 2016.

A payment made in August, to which Simo referred at Sunday’s press conference, was made by InterBancos in relation to the annual contract for technical support services, not to software licencing, it said.

“None of the registered letters and emails sent by Bizfirst to the administrations of Simo and InterBancos have ever been answered,” it added, listing the different attempts at communication.

There were letters of “expression of availability to talk, successive extensions of deadlines to legalise the illicit use of software, warnings that if the situation were not legalised, the licenses would expire, and finally that the matter had been handed over to the lawyers”.

The Mozambican Interbank Company (Simo) yesterday announced that there was no forecast as to when its ATM and POS network, as well as other debit card operations, would resume operations.

Millenium Bim debit cards, ATMs and POS machines are the only ones still working, because they are connected to a different network.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.