Mozambique to invest €20M in sanitary landfills for Nampula and Nacala

Moody’s more optimistic on Mozambique following ENI’s investment decision

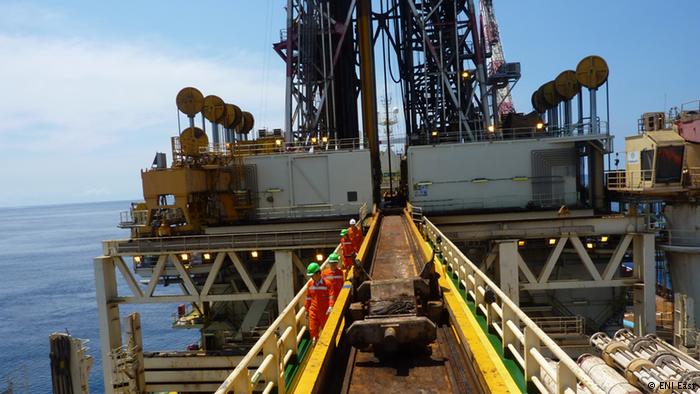

DW / ENI natural gas prospecting platform in the Rovuma Basin, northern Mozambique

Moody’s rating agency have indicated that the signing of Italian oil company ENI’s Mozambique final investment decision was positive from the credit point of view.

In a comment published on June 6, the rating agency said it believed that although it expected “economic growth to gradually recover over the next three to four years, approaching historical averages, the start of production and exports of the Coral South Project, as well as other projects that will begin to produce, will fuel a substantial increase in growth”.

The ‘comment on a relevant event’ does not constitute a rating action, and Mozambique’s valuation remains below the investment recommendation, or ‘junk’, as it is generally known. But Moody’s points out that “the US$7 billion project, which is expected to start production in 2022, is positive from the credit standpoint because it benefits the Mozambican economy”.

History of the ENI project

On June 1, ENI and the President Filipe Nyusi of Mozambique held a ceremony to mark the official start of the project to extract liquid natural gas.

ENI noted that the Coral South project was the industry’s largest final investment decision in the last three years and would also be the first platform for the production of liquid natural gas in Africa.

This was taking place in a project scrutinised by 15 financing partners, the oil company BP, which will buy all production for 20 years, and by the American company Exxon which will also enter the project.

The area contains the world’s most important natural gas discoveries in the last 15 years.

ENI East Africa (EEA) holds a 70 percent stake in Area 4, while Galp, ENH and Kogas hold 10 percent each.

Once an agreed transaction between EEA and Exxon Mobil has been completed, the participating interests of ENI and Exxon Mobil will stand at 25 percent apiece, with CNPC holding 20 percent and Galp, ENH and Kogas holding 10 percent each.

US-based Anadarko Petroleum also plans a significant investment in the Rovuma Basin with a project budgeted at US$15 billion, but a final investment decision has yet to be announced.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.