MP charged for accusing Lesotho king of signing over country to South Africa

Investors are waiting for an end to SA’s ‘policy stalemate’, says Moody’s

Cyril Ramaphosa’s hands are tied until he has a firmer mandate, says a senior analyst

The foreign investment community is waiting for the outcome of SA’s general election in 2019 and to judge what policies will be formulated and enacted before committing to the country, said a senior analyst at Moody’s ratings agency.

The fight for control of the levers of power in government is under way, with Cyril Ramaphosa replacing Jacob Zuma as president of SA and the ANC.

Zuma, who was mired in allegations of corruption before and during his nine-year tenure as president, is reported by the Sunday Times to be staging a fightback against Ramaphosa. Zuma and those close to him oversaw rampant corruption at state-owned companies and Ramaphosa’s government is driving investigations into maladministration, mismanagement and theft.

Ramaphosa is generally seen as more pragmatic and keenly aware of the need to attract foreign investment to stimulate a moribund economy, but he cannot act until he has a firmer mandate after the 2019 election because his hold on power now is tenuous as he works to prevent the ANC from fracturing into factions as Zuma and others agitate against him.

“There’s effectively a policy stalemate,” said Douglas Rowlings, vice-president senior analyst at Moody’s.

“The outside investment community is appreciative that things can’t just suddenly change. This is effectively a big oil tanker headed in one direction and is now being nudged into a different one. It takes a while,” he said.

“I think one of the main focus points is what happens post-elections next year. It’s largely a wait and see. There’s a lot of side-lining going on. A lot will be dictated by what is translated into policy and what policies are being delivered upon after elections,” he said.

He argued that the worst in terms of mine closures and jobs cuts in platinum and gold were already in the market and this could be positive, certainly for an oversupplied platinum market.

Impala Platinum, the world number two source of the metal, has said it will cut up to 13,000 jobs over the next few years and cut its production capacity by 130,000oz of platinum by 2021, while Lonmin, the number three platinum miner, is the subject of a takeover bid by Sibanye-Stillwater.

Lonmin has indicated job cuts of 12,600 as it closes old, unprofitable mines and Sibanye has indicated it will remove 140,000oz of platinum by 2021 from its merged assets comprising Lonmin, Aquarius Platinum and the Rustenburg mines once owned by Anglo American Platinum.

“Most of the haircutting has been put into the market and it will be delivered on. As this supply discipline comes in, this will naturally create positive price momentum and these supply cuts will ensure the sustainability of the sector,” Rowlings said.

He and his colleagues think the rand price for platinum has bottomed out and will show gains over the next two to three years.

Rowlings and his team released a report on the effect of the rand’s fluctuations against the dollar and what it meant for SA’s gold, platinum group metals and diamond sectors.

Unlike dollarised economies, where costs and revenues are all dollar-denominated, SA’s miners were in a fortunate position where the rand’s weakness has offset falling gold and platinum prices, keeping the rand revenue line more or less steady this year.

“The good thing with the volatility in commodity prices driven by dollar movement is not being translated into volatility from a rand pricing point of view. That’s the way to look at SA mining, not through the dollar lens in which commodity prices are denominated,” Rowlings said.

While the news is good on the revenue front, with gold and platinum miners shielded by the worst of the falling prices, there is a concern that the costs of labour and electricity have increased well above inflation in recent years and this is putting profit margins under pressure.

“Costs are, to within a certain extent, in management control, which is a positive for us,” Rowlings said.

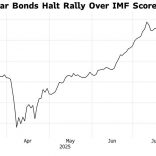

A key worry for the market is a potential de-coupling of the rand which is moving counter to the dollar. If the local currency moves in tandem with a firming dollar, appreciating in value as it did soon after Ramaphosa came into power in February that will bring down the rand price of commodities, putting mining companies under pressure.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.