Portugal's Galp takes step to start arbitration over Mozambique capital gains tax dispute

ENI-Exxon capital gains tax set at $350 mn – but questions raised – By Joseph Hanlon

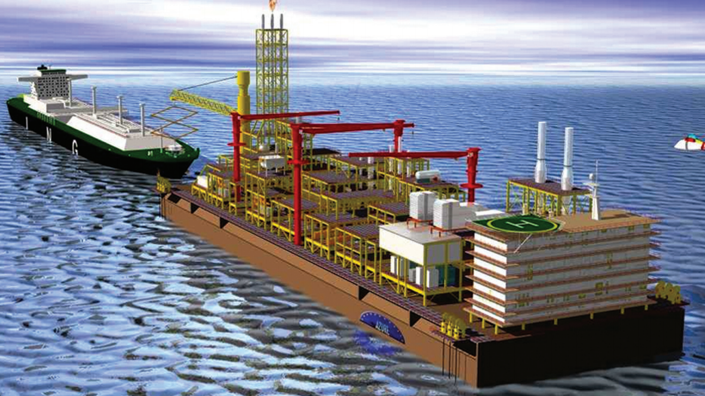

File photo

Mozambique tax authorities (Autoridade Tributaria – AT) on 21 March set the capital gains tax to be paid by ENI at $350 mn. This is in the range that had been predicted. The tax is for selling 35.7% of ENI East Africa for $2.8 bn to Exxon Mobil. In effect, ENI sold 25% of the Rovuma Area 4 gas field.

In its statement, AT said that under the dual taxation agreement with Italy all of the capital gains tax goes to Mozambique. It continues that under the 2007 law, the capital tax is 32% and it applies to only 50% of the gain after ENI’s costs and investments have been deducted. Working backwards, this means the AT has calculated ENI’s costs at $612 mn.

But a report issued this morning by CIP (Centro de Integridade Publica) raises two questions. Author Fatima Mimbire first questions the 50% discount, which she says has never been applied before to capital gains tax. Second, she notes that the AT has given no details about how it has calculated the ENI’s costs. The AT says only that this is based “on information available at this time and supplied by ENI,” and Mimbire argues that relying only on company data without any outside evaluation is “problematic”. She goes on to point out that the national auditor (Tribunal Administrativo – TA) in its audit of the 2015 state budget criticised the was the AT had calculated capital gains tax on an earlier part sale by Anadarko.

The tax authority report is on and the CIP report on . Both are in Portuguese.

By Joseph Hanlon

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.