Mozambique: Mining suspension in Manica province awaits decision from MIREME - report

Gemfields confirms G-Factor for Mozambique’s Montepuez ruby mine and Zambia’s Kagem emerald mine

FILE - For illustration purposes only. [File photo: Gemfields]

- Gemfields releases updated ‘G-Factor for Natural Resources’ figures to 31 December 2024

- London, 4 June 202 5

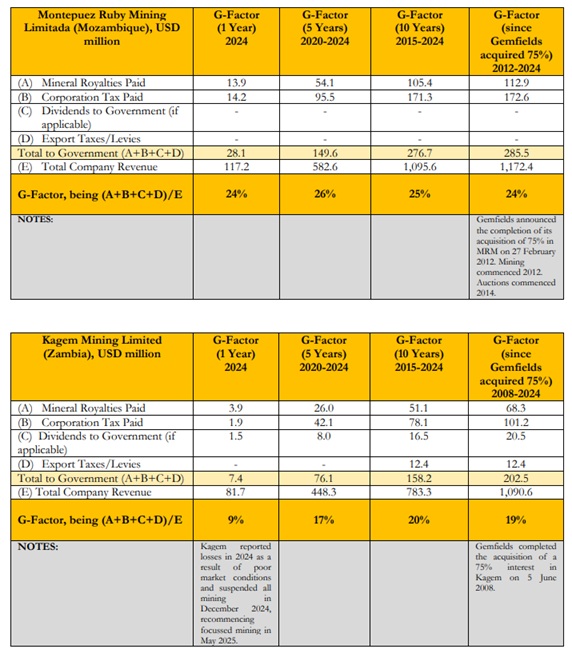

Gemfields is pleased to confirm its ‘G-Factor for Natural Resources’’ figures for the Kagem emerald mine in Zambia and the Montepuez ruby mine in Mozambique, which now stand at 20% and 25% respectively for the 10-year period from 2015 through 2024. The ‘G-Factor for Natural Resources’ reveals the percentage of natural resource revenue paid to the government of the country from which the resource is derived.

First announced in 2021, Gemfields shares its ‘G-Factor for Natural Resources’ annually in an effort to promote greater transparency and accountability regarding the level of natural resource wealth shared with the host country’s government, whether that value originates from the mining, oil, gas, timber or fishing sectors. It is also an indicator of the efficiency of natural resources companies in converting those natural resources into funds for the host government.

In 2024, Zambia became the first country in Africa to publish ‘G-Factor for Natural Resources’ data for key mining companies on its Zambia Extractive Industry Transparency Initiative (ZEITI) Online Fusion Portal (http://portal.zambiaeiti.org), a pioneering step providing Zambian citizens with direct insight into their country’s participation in its natural resources.

Gemfields’ CEO, Sean Gilbertson, said:

“Gemfields’ 2024 G-Factor for Natural Resources figures highlight the contrasting contributions that a mining company can make to its host country depending on the prevailing operating and market conditions. Despite a challenging in-country context, Montepuez Ruby Mining was able to return a robust 24% of its revenue to the Government of Mozambique given a resilient ruby market. Conversely, the widely documented adverse market conditions for Zambian emeralds in the second-half of 2024 impacted profitability at Kagem. Indeed, Kagem reported losses in respect of 2024, suspended mining operations at the end of the year and saw its 2024 G-Factor falling considerably to just 9%. Focussed in-pit mining resumed in May 2025 and, should the improving market conditions for Zambian emeralds continue, Kagem’s G-Factor should again return to its long-term average of circa 19%.

“While Kagem had a poor 2024, we remain committed to the transparency brought by the G-Factor for Natural Resources and we hope this candidness will encourage others to adopt the G-Factor, allowing host governments and their citizens to better understand the performance of the custodians of their resources.”

G-Factor for Natural Resources computations for Gemfields’ two key mining subsidiaries (the Kagem emerald mine in Zambia and the Montepuez ruby mine in Mozambique) are set out below:

The G-Factor for Natural Resources would typically be calculated by each standalone company engaged primarily in the extraction and sale of natural resources, whether in the mining, oil, gas, timber or fishing sectors. Accordingly, multi-national natural resource companies would publish the G-Factor for Natural Resources for each operating subsidiary engaged primarily in the extraction and sale of natural resources.

The G-Factor for Natural Resources is expressed as a percentage and is calculated as:

where:

• A = the total mineral royalty (tax on revenue) paid by the reporting company to the host country government during the period

• B = the total corporation tax (tax on profit) paid by the reporting company to the host country government during the period

• C = the dividends paid by the reporting company to the host country government during the period (where the host country government is a shareholder in the reporting company)

• D = the total export taxes or export levies paid by the reporting company to the host country government during the period

• E = the total revenues of the reporting company during the period

• p = the relevant period, typically calculated for each of (i) the prior year; (ii) the preceding 5 years and (iii) the preceding 10 years

• The sums actually paid during the period (rather than the sums accrued or falling due during the period) are used for the purposes of A, B, C and D.

No measure of this type is perfect and it is recognised that:

a. the G-Factor for Natural Resources is a “rule-of-thumb” – while it has broad application and is a practical indicator, it is not suited to every situation;

b. there are numerous additional and indirect taxes which are not included in the G-Factor for Natural Resources and which further increase the contribution made to host nations by natural resource companies. Such taxes include but are not limited to area/surface charges, social security contributions, taxation on the salaries of employees, import and export duties, VAT, etc; and

c. the variety and variations in natural resource deposits, types and occurrences lessens the ability to make direct comparisons between companies

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.