Mozambique: Overtime payments will be staggered, says Minister

Fund manager says Mozambique can not expect understanding from creditors

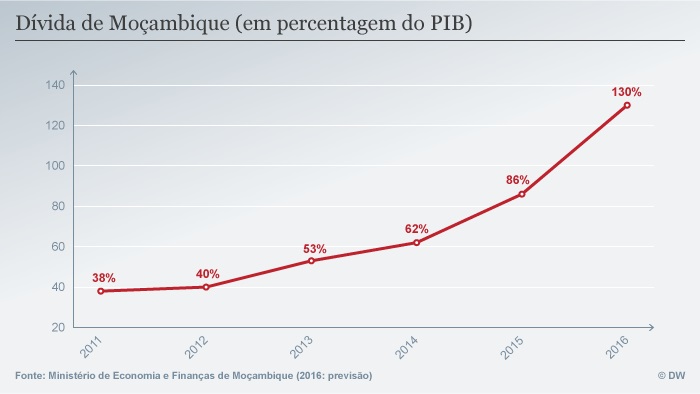

Deutsche Welle / Mozambique's Ministry of Finance / Mozambique's debt against GDP

On February 3, at the end of the period of grace on the US$60 million January repayment on public debt issued in April of last year, Mozambique officially fell into financial default.

Mozambique cannot expect leniency or understanding from creditors after failing to make the repayment, a fund manager who has invested in Mozambican debt says.

“Our view is of course negative, and with the non-payment of the January coupon, the country has shown its unwillingness and should not expect any understanding or mercy from the holders of public debt securities,” a fund manager at Landesbank Berlin Investments told financial information agency Bloomberg, quoted by Lusa.

Mozambique thus becomes the first country on the continent to fail to make a debt repayment since the Ivory Coast was unable to honour its financial commitments in 2011. The failure to pay was confirmed by several analysts and holders of debt securities to the Bloomberg financial information agency, and comes as the natural consequence of the announcement by the Mozambican government itself, two days before the deadline, that it would not pay the almost US$60 million that it owed to the holders of the approximately US$727 million in sovereign bonds that Mozambique issued in April last year.

The Mozambican Ministry of Finance confirmed on January 16 that it would not pay this month’s installment of US$ 59.7 million for sovereign debt maturing in 2023, thereby entering into default.

“The Ministry of Economy and Finance of the Republic of Mozambique wants to inform the holders of the US$ 726.5 million maturing in 2023 issued by the Republic that the payment of interest on the notes, worth US$ 59.7 million, which is due on January 18, will not be paid by the Republic,” the statement read.

In the document, Mozambique recalled that it had warned of lack of liquidity during this year last October and stressed that it views lenders as “important long-term partners whose support for the necessary resolution of the debt process will be critical to the future success of the country”.

Partial financial default

Following this announcement, Standard & Poor’s cut the country’s rating to ‘SD/D’, that is, partial financial default, and found that non-payment was a government strategy to force debt holders to negotiate a debt restructuring, which they have so far rejected.

Fitch maintained the country’s current rating but warned that Mozambique’s failure to pay the January installment would “increase the uncertainty” over the restructuring of sovereign debt issued in April last year.

Moody’s, for its part, also considered the nonpayment a default, but did not lower its rating, since it considers its Caa3 assessment already implies an assumption of potential losses to lenders of 20 to 35 percent, possibly rising to a historical sovereign default average of almost 50 percent.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.