UNESCO board selects Egypt's former antiquities minister El-Enany as new chief

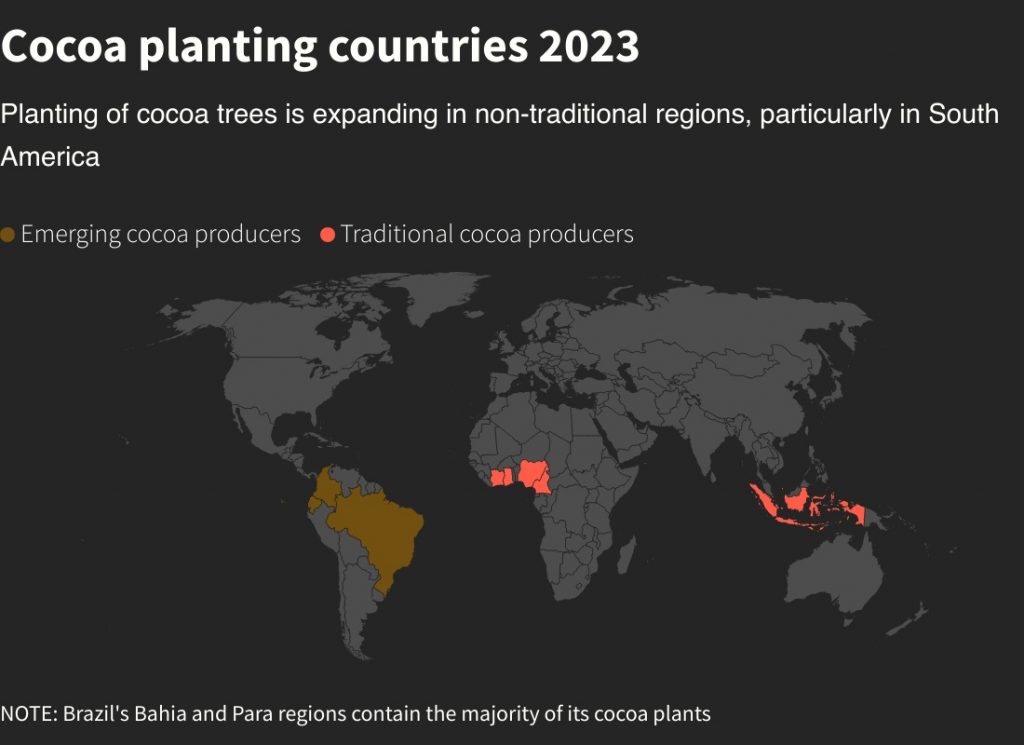

Farmers plant more cocoa outside Africa as prices rally

Seedlings of cocoa trees are pictured at a plantation managed by the Schmidt Agricola farming group in Bahia state, Brazil. [Photo: via Moises Almeida Schmidt]

Schmidt Agricola is a large agricultural company producing soybeans, corn and cotton in Bahia, Brazil, one of the country’s new-frontier agricultural areas fit for large-scale, high-tech farming. It recently added a new crop to its fields: cocoa.

Brazil’s government projects output could grow to 300,000 metric tons by 2025 and to 400,000 tons by 2030, from around 200,000 tons currently, which would turn the country from a net importer to a regular exporter of the commodity.

Ecuador has become the third largest global grower, behind Ghana which produces around 750,000 tons. The top grower is Ivory Coast with 2.2 million tons.

Anecacao, which last July received record attendance of around 70 buyers from Asia, the United States and Europe for a trade and expo conference in Guayaquil, estimates production could continue to grow to as much as 800,000 tons by 2030.

Large-sclae farming

Some of the new plantings in South America look huge when compared to the small holdings in Africa. Most producers in Ivory Coast and Ghana have around 5 hectares.

Schmidt Agricola has planted 429 hectares with cocoa, fully irrigated.

“You will need technology, you need to seek higher yields to be more profitable. Grains and fiber (cotton) will continue to be the main crops for us, but we see cocoa gaining more area in the next five years.”

High-tech, irrigated areas such as Schmidt’s have produced as much as 3,000 kg of dry cocoa beans per hectare (ha), while the new areas in Brazil’s Amazonian state of Para produce around 2,000 kg/ha.

That is much higher than the Ivory Coast’s average yield pf 500 to 600 kg/ha, which is similar to Ecuador. Ghana’s is smaller at around 400 kg/ha.

Jeroen Douglas, director of the Netherlands-based non-profit Solidaridad, which targets more sustainable supply chains, sees Brazil’s role in the market growing, in the same way it has with other agricultural commodities such as soy and corn.

“On Brazil, once the mindset is: ‘yes, we want to get into this commodity’, there’s no way of stopping them. That mindset is not there yet, but I think we are getting to a tipping point,” Douglas said.

Back to farming

Brazil’s Amazonian state of Para is undergoing a revival in cocoa growing.

“There are people coming back to the farms, people that left in the past to try jobs in towns,” said producer Jose Garcia, who farms cocoa on 70 hectares (172 acres) that used to be pasture in the municipality of Medicilandia, Para state.

Those new orchards in the Amazon region would have an advantage in the European market since restricts commodity imports from areas that have been deforested for planting crops.

“If you plant cocoa trees there (Amazon region), it is considered reforestation,” said Douglas.

Organizations such as UN’s International Fund for Agricultural Development (IFAD), on the other side, seek to preserve the market share of small farmers, including African cocoa producers.

IFAD’s head Alvaro Lario said it was important for smallholders to improve productivity, distribution and marketing. The agency organizes training on agricultural techniques to increase production per hectare.

A broker at an international commodities trader, who asked not to be named due to the sensitivity of the topic, believes that chocolate companies are willing to source more cocoa away from Africa due to sustainability issues related not only to deforestation, but also to child labor.

“They (companies) are tired of trying to defend their business there, and certainly considering moving some of that business elsewhere”, the trader said.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.