Mozambique: Government failed to repay 3.4 billion meticais of debt

Economist João Mosca paints black portrait of Mozambique’s economy

DW / João Mosca, professor and director of the Rural Environment, says that Mozambique's economy is unable to generate sufficient resources to pay the public debt.

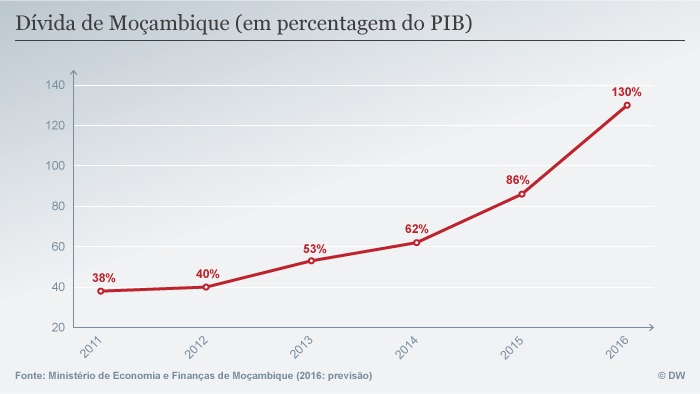

Mozambique does not have the financial resources to pay off its public debt, currently estimated at US$ 15 billion, on its own. The ‘hidden debts’, contracted from 2010 on in an unsupervised manner during the last term of former president Armando Guebuza, represent about ten percent of that amount.

According to researcher João Mosca, the problem is the inability of the Mozambican economy to generate sufficient resources, and the fact that the public accounts “continue to be negative”.

Professor Mosca spoke to DW Africa on the fringes of a “Lusophone Africa, a Prospective Vision” conference entitled “Mozambique, between the crisis and a new economy” in Lisbon this morning (28-03).

Negative impact on credibility and trust

The consequences of Mozambique’s default have a negative impact, in particular on credibility and confidence in governance and the economy, contributing to a downturn in investment and the rise in interest rates with consequent effects on debt volume and services. This forces more resources to be paid servicing debt, reducing the capacity of the Mozambican state to provide services. This is how economist João Mosca assesses the consequences of Mozambique’s inability to fully meet its international financial commitments.

“Internally also the confidence of citizens, especially of the entrepreneurs who invest, falls,” Mosca says, adding that “international credit and investment change completely, although in some areas – for example in the gas issue – this element is not as determinant. But it is important in any case to know that it is a country that has difficulties or cannot, at least in the first two tranches (instalments), honour its commitments, so the situation is negative”.

Operation without significant economic effects

João Mosca considers the sale of Eni’s Rovuma Basin shares to ExxonMobil r to be “extraordinary” or “unique” and says that the operation will not change the perception of international investors regarding the default, as it will have no significant economic effect.

“It will certainly serve well to pay off debt without any effect on the economy, on the capacity of the state, the capacity of investment by the businesspeople, internal changes in the economy, this is not going to reflect in any way. Therefore, it is money that enters on one side and goes out on the other. Of course, this may have some effect due to debt reduction in terms of interest.”

However, documents are beginning to appear that question the evaluation of capital gains on the sale. It is suspected that they have been undervalued, and that, according to João Mosca, there have been technical problems or lack of transparency.

Legitimacy of company debt

Mosca also spoke about the legitimacy of ProIndicus, Ematum and MAM debts contracted without parliamentary scrutiny.

“These hidden debts were illegal, untransparent, and a minority of people, even in government, knew about them.” They were fraudulent to the extent that the volume and values and interest rates agreed were absolutely out of line with the market. They were, even technically, badly made investments. The fishing boats did not meet cold-storage conditions, seaworthiness, navigational instruments, or fishing capacity for the purpose that was envisaged. “There is also the problem of the legal status of the company itself, in order for it to be able to fish in international waters and even in conditions governed by international shipping, so almost everything is wrong in this process,” the economist said.

State Budget remains negative

In view of the facts, João Mosca maintains that Mozambique does not have the financial capacity to repay its debt because “the state budget remains negative. The balance of payments continues to be negative and if only because of this, there is there no way to change this negative trend in the medium term – 4 , 5, 6 years or more. The only capacity that can be obtained is through inflows of financing to pay unpaid financing. And hence it will necessarily have to come from the International Monetary Fund and other financial organisations. It’s not worth thinking about,” the economist warns.

In addition to the support of the International Monetary Fund, Mosca suggests “eventually a reduction in lenders’ interest rates” and “some penalisation of banks that acted in bad faith”, because, he adds, “there was a lack of seriousness of all the parties – government, companies and creditors, including mediators – around the financial network [which was put in place] for such investments”.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.