Breaking: The U.S. government confirms the continuation of the Millennium Challenge Corporation ...

Debt service relief for low-income EMs may be extended into 2021 – Ficth

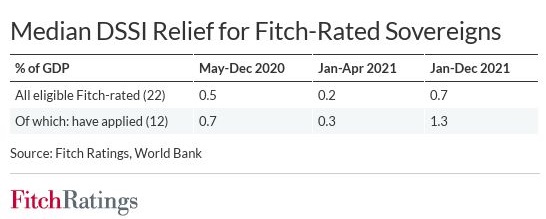

An extension of the G20 Debt Service Suspension Initiative (DSSI) for low-income emerging markets (EMs) is likely, possibly at the G20 meeting in November 2020, Fitch Ratings says. An extension, which could cover the whole of 2021 or only part of the year, would amplify the benefits available under the scheme.

The G20 agreed in July to consider a possible extension of the DSSI, which offers relief to 73 eligible low-income countries on debt service payments (principal and interest) due between May and December 2020. The payments covered are suspended, not forgiven, but with a repayment period of three years, a one-year grace period and a net-present value neutral structure. The G20 has emphasised that the DSSI is intended primarily to address liquidity issues that constrain countries’ spending on coronavirus pandemic relief. Debt sustainability problems, which are also gaining in prominence, would need to be addressed separately.

As of mid-July, 42 countries had applied to participate in the initiative. Among Fitch-rated sovereigns, 12 of 22 eligible countries are known to have applied. We believe the number of applicants may increase if the benefits of participation are boosted, for example by an extension of the initiative, or if creditors in some cases decline to engage in bilateral re-structuring negotiations outside of the DSSI framework.

According to data on scheduled debt service payments published by the World Bank, only five of the 22 Fitch-rated DSSI-eligible sovereigns – Angola, Mozambique, the Republic of Congo, Pakistan and Laos – would see their external financing requirement for 2020 reduced by 1% of GDP or more through participation. The benefit to Angola, at 4.3% of GDP, is by far the highest. Of these five, only Laos has not applied for participation. Laos has not requested IMF financing, which is a precondition of application for the DSSI.

An additional eight Fitch-rated sovereigns would see a benefit of at least 0.5% of GDP. For nine sovereigns, the benefit in 2020 would be less than 0.5% of GDP; participation in the programme is lowest in this group. Although the external financing benefit is smaller for these 17 countries, debt service relief would free up funds for healthcare. Relative to existing public healthcare spending, which is low in many of these countries, the amounts involved could be significant.

The G20 has encouraged private-sector investors to provide debt service relief along lines similar to the bilateral relief provided under the DSSI, but it has not made this a requirement for participation. So far, none of the DSSI-eligible countries has said publicly that they would seek equivalent treatment from private-sector creditors, partly reflecting concerns about compromising their market access.

The DSSI focuses only on debt to official creditors, which under Fitch’s rating criteria is not covered by our default definition. If sovereigns request debt service suspension from private creditors, this could qualify as a distressed debt exchange and lead to the rating being revised to ‘RD’ if Fitch judges it is necessary to avoid a traditional payment default.

Even if the private sector is not participating, a request by a sovereign to participate in the DSSI could be a signal of distress, amid broader pressures associated with the pandemic that could negatively affect ratings. However, in most cases the signalling effect will be limited, given the typically small size of the relief, and ratings already reflect the stress from the initial pandemic shock. Meanwhile, suspension of debt service to official creditors may also relieve near-term liquidity pressures faced by sovereigns participating in the scheme.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.