World Bank lowers Mozambique’s growth forecast to 1.8% this year

Covid-19: Electricity price to drop 10% as of June, parliament aproves VAT exemptions – Mozambique

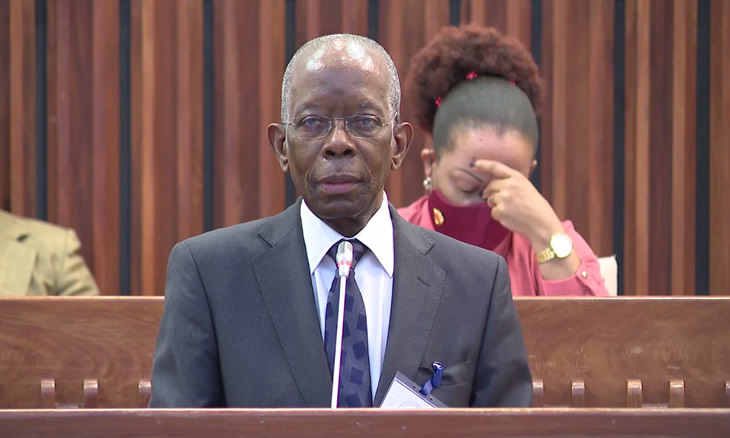

Photo: O País

The Minister of Economy and Finance of Mozambique, Adriano Maleiane, announced today in the Assembly of the Republic a 10% reduction in the price of electricity as of June, in the context of mitigating the impact of the pandemic of Covid-19.

“Starting next month, all general rate consumer customers, all of them, will have a 10% reduction in the bill,” said Adriano Maleiane.

The move is yet another contribution to try to mitigate the effects of the pandemic caused by the new coronavirus, he added, without providing further details about the decision.

Within the scope of measures to soften the impact of the Covid-19, the Mozambican parliament approved today by consensus, in general, the exemption of 17% Value Added Tax (VAT) on sugar, cooking oil and soaps, aiming to mitigate the cost of goods essential in view of the negative impact of the new coronavirus.

The exemption will last for a period of one year, explained the Minister of Economy and Finance, Adriano Maleiane, who presented the proposal in parliament.

Within the scope of support measures, the Prime Minister, Carlos Agostinho do Rosário, announced a week ago that the National Institute of Social Security (INSS) will provide around 600 million meticais (7.9 million euros) for financing small and medium-sized enterprises – without, however, specifying the nature of the support or the conditions of access.

Also within the scope of support vis-à-vis Covid-19, on March 22 the Bank of Mozambique announced measures to support companies and families that suffer from the impact of the pandemic caused by the new coronavirus on the economy, after an extraordinary meeting of the board of directors.

The central bank announced the “introduction of foreign currency lines of credit for banks and relaxation of the conditions for restructuring bank customers’ credits to mitigate the effects” of Covid-19.

“These measures reinforce the decisions previously taken and aim to provide liquidity in foreign currency and in national currency to support companies and families to honor their commitments, following the worsening of the risks resulting from macroeconomic impacts”, he justified.

The measures consist of “introducing a foreign currency financing line for the institutions participating in the Interbank Foreign Exchange Market, in the global amount of 500 million dollars [467 million euros], for a period of nine months”.

It was also authorised “the waiver of the constitution of additional provisions by credit institutions and financial companies in cases of renegotiation of the terms and conditions of the loans, before their maturity, for customers affected by the pandemic”.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.