Mozambique: Standard Bank believes resumption of LNG project will improve business confidence - AIM ...

Business risk: Coface downgrades Mozambique, four other African economies

Coface

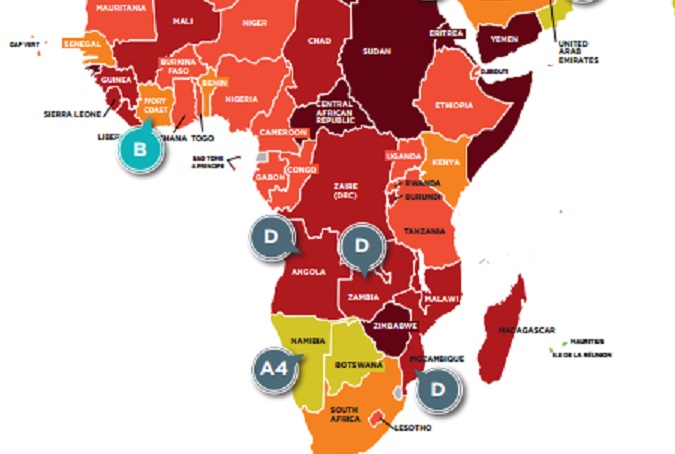

The French credit insurer Coface downgraded five African countries – Algeria, Namibia, Zambia, Mozambique and Angola – in its latest quarterly assessment of the risk of company default.

In contrast, the Ivory Coast, whose growth and political context are considered particularly favourable, sees its rating upgraded a notch.

The double shock of lower hydrocarbon prices and the slowdown in Chinese growth (also demoted) is weighing heavily on African economies and the solvency of companies active in the region, according to the latest edition of the French credit insurer Coface’s quarterly evaluation, presented on Wednesday 29 June.

Algeria, where hydrocarbons contribute 95 percent of external revenue and 60 percent of the state budget, was downgraded due to “weaker margin for manoeuvre”. Previously considered rather a good student (A4, “suitable risk”), its score was reduced by one notch in January of this year (B, “rather high risk”) and slid again on Wednesday .

Coface notes that the impact of the oil shock could be limited by expansionary fiscal policy, but growth prospects are expected to decline as savings sought by Algiers are not enough to contain a galloping budget deficit.

For the agency this justifies a further downgrade to category C (“high risk”). “Manoeuvre margins are still lower than in other African countries highly exposed to hydrocarbons and mineral raw materials,” Marie Albert, in charge of country risk at Coface, says.

For similar reasons, Namibia (A3) and Zambia (C), which had been placed on negative watch in January, are also downgraded, respectively to A4 (risk “suitable”) and D (“high”).

Mozambique has slid from C to D as a result of the revelation of hidden debts that could bring the total weight of its debt to 90 percent of GDP in 2016. “The probability of sovereign default increases,” Coface notes.

Finally, Angola, which has requested assistance from the IMF, is downgraded to category D.

Conversely, the Ivory Coast, which had been placed under positive watch and whose growth rates are between 8 and 9 percent per year, has attracted favourable attention, going up a notch to B.

With the new report, Coface’s seven-step scale, from A1 “very low” risk of default to D, “very risky”, is expanded to include a new category for countries where the risk of company default will now be considered “extreme”. The Central African Republic, Eritrea, Libya, Sudan and Zimbabwe have been placed in this category from the outset.

In 2014, Coface guaranteed EUR508 billion of business loans against default, 6 percent in Africa and around the Mediterranean.

For the full report, see:

file:///C:/Users/user/Downloads/A-Panorama+RP-GB+Juin+2016+Fiches-WEB-HD.pdf

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.