World Bank lowers 2025 Mozambique growth forecast to 3%

Blackout ends: Financial transactions return to normal – AIM report

Photo: O País

After a five day blackout, the electronic systems of Mozambican commercial banks were operational again on Wednesday morning – but only because the banks defied Rogerio Zandamela, governor of the Bank of Mozambique, and promised to pay the money demanded by the Portuguese company Bizfirst, the owner of the computer application used.

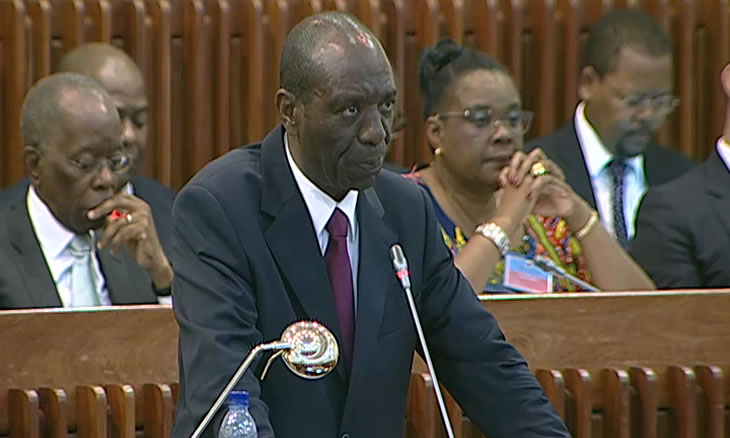

Speaking at the Mozambican parliament, the Assembly of the Republic, Prime Minister Carlos Agostinho do Rosario, announced “a solution has been found, implemented immediately, to normalise financial transactions through the use of ATMs and POS (Point of Sale) card readers”.

“Thus as from the early morning of today, the ATMs and POSs linked to the SIMO (Mozambican Interbank Company) began to function”, he declared.

Rosario did not say what this solution was, or how it had been implemented so quickly – but anyone who read the daily paper “O Pais” or the independent newssheet “Mediafax” would know that the banks had negotiated Bizfirst’s demands for payment.

SIMO had been in a bitter dispute with Bizfirst, which on Friday morning had cut the application on which the electronic transactions depend. All debit cards, ATMs and POS card readers linked to the SIMO system went down. Only the largest of the commercial banks, the Millennum-BIM (International Bank of Mozambique) was unaffected because it is not part of the SIMO network.

On Sunday the SIMO chairperson, Gertrudes Tovela, accused the Portuguese company of “blackmail”. She claimed that SIMO had paid Bizfirst all that was owing, and in advance. The same day, Bizfirst retorted that SIMO had not paid the licence fee for the Bizfirst software for the last two years.

At a hearing on Tuesday with the Assembly’s Plan and Budget Commission (CPO), Zandamela upped the stakes and accused Bizfirst, not merely of blackmail, but of cyber-attacks. He said resuming relations with Bizfirst was out of the question.

Zandamela claimed that SIMO (which is 51 per cent owned by the Bank of Mozambique) did not owe a penny, and that Bizfirst had chosen to use “the nuclear option” against Mozambique. “This is not a normal way of dealing with business matters. Never in my life have I seen this kind of solution, bringing a country or a system to its knees”.

In response to the alleged cyber-attacks, the central bank immediately began drawing up contingency plans, so that Mozambique would be prepared, with an alternative system, if Bizfirst did indeed pull the plug. The Bank of Mozambique identified a software supplier “of international repute”, Zandamela said, but before it could come to Mozambique, Bizfirst struck last Friday, and the SIMO system went down.

But the commercial banks, who own 49 per cent of SIMO, were not prepared to wait for the new supplier and, in clear defiance of Zandamela, decided to pay Bizfirst.

After Zandamela’s testimony before the CPO, the Mozambican Association of Banks (AMB), according to “Mediafax”, contacted the government, and received the go-ahead to negotiate with Bizfirst. Zandamela received instructions “from the highest level” not to interfere.

Paulo Sousa, the chairperson of the Executive Commission of the BCI (Commercial and Investment Bank), the second largest bank in the country, headed the negotiations with Bizfirst, carried out by telephone.

An initial Bizfrst demand for five million euros (4.4 million US dollars) was whittled down to three million, covering the service and maintenance contracts. The deal was struck at about 21.00 on Tuesday evening, but Bizfirst refused to restore the service immediately. The company’s lawyers insisted that all the banks in SIMO must sign the contracts first. Each would pay in accordance with its share in SIMO. The payments will be made in two instalments.

One oddity was that Bizfirst insisted that the contract be signed in the name, not of SIMO, but of Interbancos, a company that no longer exists. Interbancos was a company that had most of the Mozambican banks as its shareholders and signed the original contract with Bizfirst. But it has been absorbed into SIMO and in October the Interbancos shareholders voted to dissolve the company.

The current solution is regarded as temporary, and gives the Bank of Mozambique and SIMO time to make arrangements with alternative suppliers. It also means that normal banking systems will be in operation over the coming festive season.

The Prime Minister told the Assembly that the government hopes all stakeholders will “ensure the implementation of sustainable and lasting technological solutions which guarantee the functioning of the interbank system with the necessary security, stability and reliability”.

Rosario assured the public that “our financial system remains stable, secure and well-capitalised”.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.