Mozambique: Syrah Resources targets Balama graphite production restart

Battle for Anadarko: who will get the gas? – By Joseph Hanlon

in file CoM

Chevron’s $33 bn bid for Anadarko, valued at $65 per share, has been topped by Occidental with a bid valued at $76 per share, and with more of that in cash. Occidental’s bid has been backed by a $10 billion investment commitment by Warren Buffet. (CNBC, Zitamar 6 May)

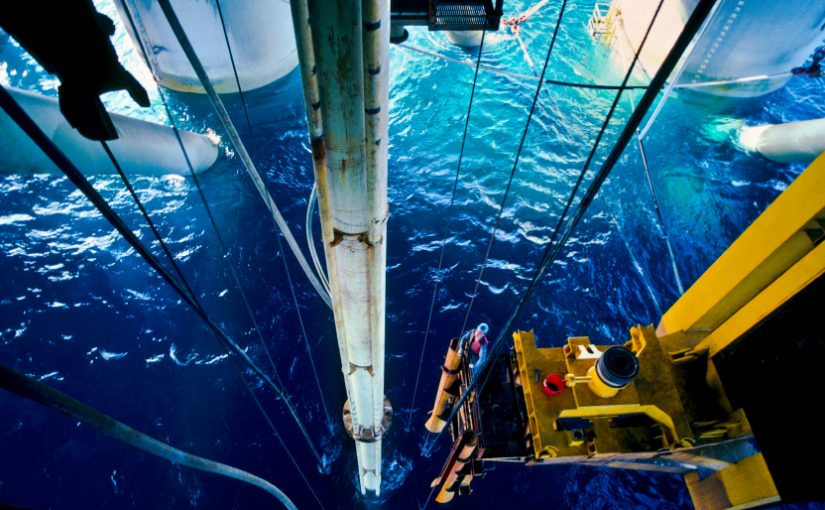

The main interest of both bidders is Anadarko’s US assets in shale gas and oil and offshore in the Gulf of Mexico. Chevron sees the takeover of Anadarko as a way of becoming a global oil and gas major; it is already becoming an important LNG producer and saw the Mozambique project as an important addition to its portfolio.

Occidental only wants the US assets and has made a deal with the French company Total to sell Anadarko’s African projects for $8.8 bn in cash, if that deal goes through. The Cabo Delgado gas field would make Total the fourth biggest LNG seller, after Qatar, Shell, and Malaysia’s Petronas. Total would probably see Cabo Delgado as more important than Chevron would because Total is aggressively expanding LNG production, and thus total would move faster on investment and production. Anadarko’s other African interests which Total would buy include part interests in oil fields in Algeria and Ghana and an exploration licence in South Africa, but Total’s main interest is Mozambique

Chevron has until Friday to raise its bid, so the outcome remains unclear.

Zitamar on Tuesday (7 May) reports Anadarko chief executive Al Walker met with President Filipe Nyusi in Maputo yesterday, and confirmed that FID (final investment decision) on the Mozambique LNG project will take place in mid-June. Work at the Afungi site, which was halted following attacks by insurgents on an Anadarko convoy in mid-February, will re-start tomorrow, Anadarko country manager, Steve Wilson, told journalists.

By Joseph hanlon

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.