CPLP: Member states' energy ministers discuss more cooperation in sector

Analysis: Mozambique thermal coal to compete with South Africa for MENA market

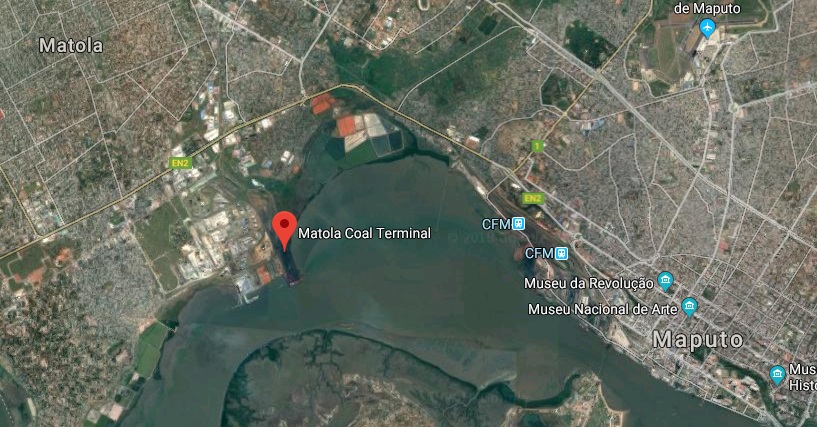

File photo / Matola Coal Terminal

Mozambican thermal coal is well placed to compete with South African material in growing Middle East and North African markets, though challenges lie in port capacity issues limiting export growth.

There was potential in Egypt for coal from Mozambique to grow its share but it will have to be sold at a discount of $2/mt to Richards Bay 6,000 kcal/kg NAR prices, an Egypt-based trader said.

The high ash and low moisture of the coal out of Mozambique created more dust than South African, making it less favorable when prices were at around the same level as Richards Bay, the trader said.

South African coal out of Richards Bay remains a popular choice for buyers in the Middle East and India, owing to a greater terminal capacity than at Maputo, Mozambique.

Maputo can handle vessels no greater than Panamax size, a Northwest Europe-based broker of Mozambican coal said.

Those capacity issues limit the port’s attractiveness to buyers, the source said, with Richards Bay Coal Terminal (RBCT) also being a more trusted and established location, meaning buyers with a conservative approach to procuring southern African coal will default to RBCT.

Currently, the dominant product out of Mozambique is metallurgical coal, with a few thermal coal producers active out of the country.

To date in 2018, 76 ships have departed Maputo, up from 57 in the same period last year, with common destinations being India, Pakistan, Singapore and Sri Lanka, according to Platts cFlow, trade flow software.

Mota-Engil to carry out EUR 51.7M works in Port of Maputo

Growing MENA Markets

Elsewhere in the MENA region, Oman said on April 8 it planned to construct its first coal-fired independent power project in Duqm, 530 kilometers south of Muscat and with a capacity of 1,200 MW.

The Omani market could be of interest to sellers of Mozambican material as the country makes a shift toward coal-powered generation, the Egypt-based trader said.

A UAE-based trader said coal from Mozambique was of growing interest to buyers in the region owing to its freight advantage.

The Egypt-based trader pegged freight from Maputo at around a $1/mt discount to freight from Richards Bay.

However, sources said infrastructure issues had been holding Mozambique from increasing exports, with buyers in the Middle East preferring to source from Richards Bay as a result.

Aside from the Omani project, the development of the Hassayan coal-powered plant in Dubai will also likely provide continued growth in the already expanding Middle Eastern market.

The Dubai Electricity and Water Authority (DEWA) began construction in November 2016 of a 2,400 MW clean coal power plant, set to be completed by 2023 and which will be Dubai’s first coal-powered plant.

Currently, the dominant consumer market in that part of the world is cement producers, leaving petcoke with a large share of the consumer market, compared with thermal coal.

Vale Mozambique coal output doubles

Cargo handling in Maputo port up by 22% – Mozambique

Coal terminal of Indian group Essar in Beira, Mozambique, starts operating in 2020

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.