African manufacturers in last-ditch bid to extend US trade programme

Anadarko cose to final investment decision – AIM report

In file CoM

The Final Investment Decision for the development of the LNG gas project to monetise gas from Offshore Area One off the coast of the northern Mozambican province of Cabo Delgado could be taken as early as March or April according to the chairperson of Mozambique’s National Hydrocarbon Company (ENH), Omar Mitha.

Speaking in New Delhi, India, on Sunday, Mitha revealed that the first liquefied natural gas will be produced from Area One in 2024. He added that the Final Investment Decision for an onshore LNG facility for gas from neighbouring Offshore Area Four is expected to be taken in July.

ENH has a fifteen per cent stake in Offshore Area One, where Anadarko is the operator. In Offshore Area Four, ENH holds a 10 per cent stake.

Anadarko is expected to take its Final Investment Decision once it has reached binding sales covering 8.5 million tonnes of LNG per annum. It has so far reached agreements for 7.5 million tonnes per year and is awaiting the formalisation of an agreement reached in November 2017 with Thailand’s PTT for the purchase of 2.6 million tonnes per annum.

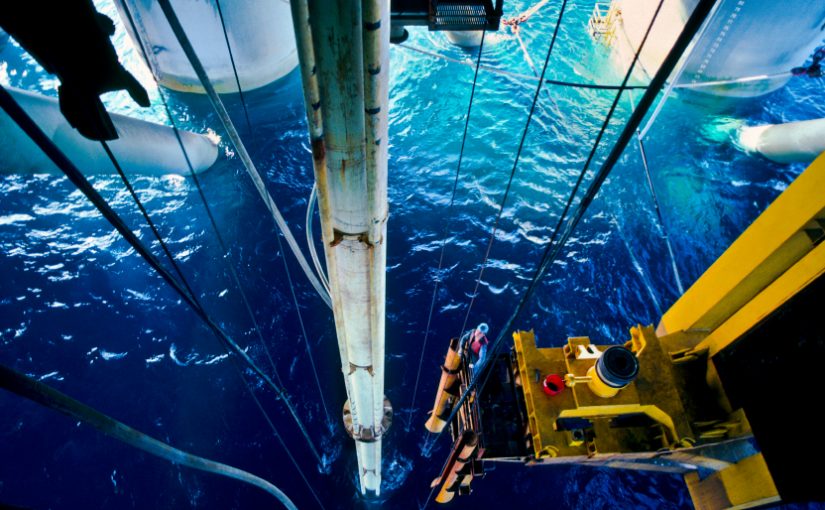

Offshore Area One is estimated to hold 75 trillion cubic feet of recoverable natural gas. To monetise the gas Anadarko will pipe it to Palma in the north of Cabo Delgado province where it will be liquefied and shipped to clients worldwide.

The Anadarko project will be Mozambique’s first onshore LNG development. It will initially consist of two LNG factories (known as “trains”) with the capacity to produce 12.88 million tonnes of LNG per year. Anadarko intends to expand the project in stages up to a maximum of 50 million tonnes a year. In addition, Area One will supply 100 million cubic feet of natural gas per day for domestic use in Mozambique.

This will not be the first LNG produced from Rovuma gas. The consortium operating Offshore Area Four in the basin, headed by the Italian energy company ENI, is constructing a floating LNG unit to sit above the Coral South Field, and it is expected to enter production in 2022.

ENI is also developing plans to build an onshore LNG facility, sharing with Anadarko the space set aside by the Mozambican government on the Afungi Peninsula. This project will be led by its partner, the US oil and gas giant ExxonMobil, and will be larger than Anadarko’s, producing 15.2 million tonnes of LNG per annum.

Anadarko is the operator of Offshore Area One with a 26.5 per cent working interest. Its partners are Mozambique’s National Hydrocarbon Company ENH (15 per cent), the Japanese company Mitsui (20 per cent), the Indian companies ONGC Videsh Ltd, Beas Rovuma Energy Mozambique Ltd and BPRL Ventures Mozambique (with 10 per cent each), and PTTEP of Thailand (8.5 per cent).

ENI holds a 25 per cent stake in Offshore Area Four. Its partners are ExxonMobil (25 per cent), China National Petroleum Corporation (20 per cent), Kogas of South Korea (10 per cent), Galp Energia of Portugal (10 per cent), and ENH (10 per cent). Area Four is estimated to hold 85 trillion cubic feet of gas.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.