Boeing to avoid prosecution in US Justice Department deal over crashes

African countries challenged to fight IFFs to achieve SDGs

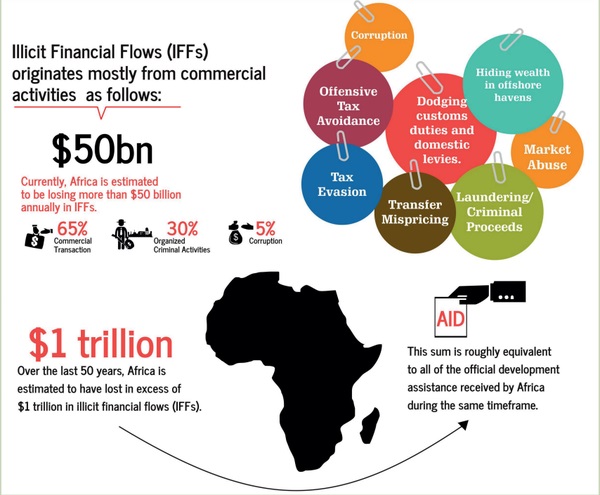

During the 5th Pan African Conference (5th PAC) on IFFs and Tax Dr Aida Opoku Mensah a senior advisor to the Executive Secretary on SDGs and special initial at the Economic Commission for Africa (ECA) said African countries need to fight IFFs since they undermine domestic resource mobilization which is a critical source of funding for the SDGs.

“If we don’t address IFF and enable countries to be able to release or get resources to implement the SDGs then the SDG implementation process will be stalled. Therefore tracing and trying to save African countries from a whole platter of illicit flows has to be very critical and has to be very crucial.” Dr Aida Opoku

According to Opoku given that SDG implementation will be financed using domestic resources the ability of African countries to raise such resources will depend on the ability to fight IFFs.

Logan Wort the executive secretary African Tax Administration Forum (ATAF) says tracking IFFs through reducing opportunity for tax avoidance and tax evasion are critical for the SDG agenda.

The 5th PAC is a declaration by tax justice Network Africa and other stakeholders in re-affirming their fight for tax justice and a call to implement the recommendations of the AU high level panel on IFFs from Africa and more broadly for the implementation of the SDGs.

It brings together stakeholders from governments, CSOs, researchers and academia to deliberate on emerging attempts to recast and reshape the IFF narrative and methodology and what this would signify for the struggle against IFF.

The stakeholders believe that tackling IFFs will be an added essential resource to mobilise the desires additional revenue.

While 120 billion dollars is the estimated cost to finance the 17 SDGs, a report of the High Level panel on illicit financial flows headed by former president of South Africa Thabo Mbeki estimates IFFs on the continent at 50 billion U.S dollars annually.

Most IFFs are perpetuated in form of over pricing, transfer pricing, trade mis-invoicing, tax evasion, money laundering, corruption and false declaration especially by multinational companies.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.