Mozambique: Government wants gradual, calibrated capital account liberalisation

Bloomberg: Mozambique, hedge funds set to face off over bond restructuring

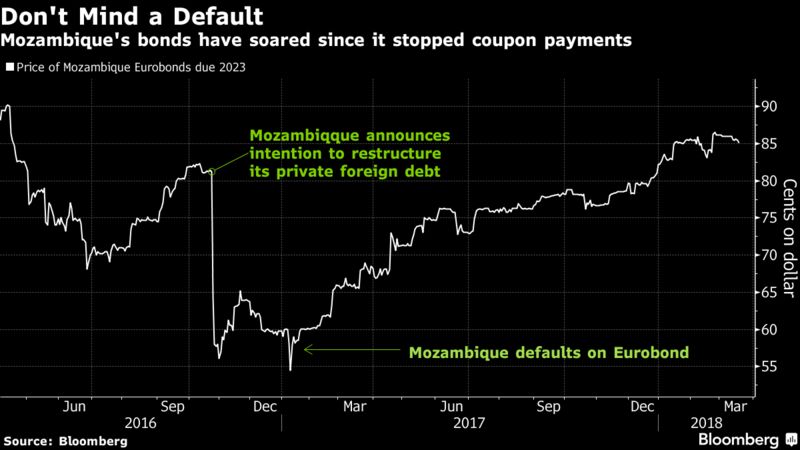

Mozambique is set to meet Eurobond investors in London Tuesday in what will mark the start of formal debt-restructuring negotiations, more than a year after the southern African nation defaulted.

Investors, which include UBS Group AG and Credit Suisse Group, aren’t sure what will be discussed. Mozambique first missed coupon payments on $727 million of securities due 2023 in January last year and has had almost no contact with the holders since then.

“We don’t really have any set expectations,” said Phillip Blackwood, managing director at EM Quest Ltd., which advises Sydbank A/S on its emerging-market assets, including Mozambican bonds. He’ll be among those attending the presentation by officials including Finance Minister Adriano Maleiane from 2 p.m. at the offices of law firm White & Case, which is advising Mozambique.

Lazard Freres SAS, the investment bank also advising the government, has only said that creditors will be updated on recent fiscal and macroeconomic developments and will also hear “the key elements of debt-restructuring proposals.”

Despite the default, the bonds have soared, with money managers betting that Mozambique’s commencement of liquefied natural gas exports around 2023 will boost the finances of one of the world’s poorest countries. The securities have made a price return — which excludes coupon payments — of almost 30 percent in the past year, the most among sovereign debt in emerging markets, according to data compiled by Bloomberg.

The presentation comes after the International Monetary Fund’s debt sustainability analysis this month, which painted a bleak picture of Mozambique’s economy and finances, suggesting it may not be in a position to start paying investors again until LNG production begins. The state admitted to $1.4 billion of previously undisclosed loans in 2016, prompting the IMF to withdraw financing and foreign donors to stop direct budget support.

Here are some possible proposals, according Stuart Culverhouse, the chief economist at Exotix Capital, which has a sell recommendation on Mozambique’s bonds:

- The best case for bondholders, albeit an unlikely one, would be for the government to announce it’s resuming coupon payments and will pay the missed ones upfront. Culverhouse calculates that the latter amounts to $136 million

- Maleiane could say that the nation will pay the missed coupons over time. Depending on the schedule and other terms, that could drive the yields on the bonds down to below 10 percent from around 15 percent currently

- Bondholders could be asked to take a haircut

- The worst situation for investors would be if the government used the IMF’s analysis to argue that it can’t pay them anything for several years

- “The country has a liquidity problem in the short-to-medium term, and debt is unsustainable, but everything changes in the middle of the next decade,” said Culverhouse

Bonds vs Loans

A key sticking point is whether the bonds will be treated like the loans of two state-owned companies, whose debt the government had failed to disclose. The bond holders insist the loans should be subordinated, if not written off, given that the legality of the state guarantees backing them has been questioned by the attorney-general.

The so-called Global Group of Mozambique Bondholders, which claims to have the backing of holders of more than 80 percent of the Eurobonds, said in a statement Monday it will insist on that.

“Accordingly, any resolution of the Eurobonds will need to reflect our position,” said Thomas Laryea, the group’s legal adviser.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.