Mozambique: Moza Banco reports H1 loss of US$2.3 million

Absa says Barclays Africa remains committed to the continent

BusinessTech

ABSA attempted to assuage South Africans on Monday following reports about its imminent sale, by saying Barclays Africa Group has reiterated that it “remains committed to Africa”.

Absa said it continued to “be optimistic about our growth prospects‚ and to operate in the normal course of business”.

This came after the Financial Times reported that London-based Barclays had decided to offload its African operations‚ which includes the Absa Group. CEO Jess Staley had allegedly appointed a subcommittee to study the sale process.

Barclays Africa shares fell as much as 6% as markets opened and was trading 4.8% lower at R137.90 by 9.50am.

Barclays Africa Group said on Monday that any announcement by its London-listed parent company would not affect the shareholding and ownership of operations in individual African countries.

The news is expected to be formally announced when Barclays plc and Barclays Africa Group announce their 2015 financial results on Tuesday.

The sale is reported to be part of Barclays plans to focus on US and UK markets.

“UK-based Barclays plc‚ which owns 62.3% of Barclays Africa‚ yesterday (Sunday) said it continues to evaluate its strategic options in relation to its shareholding in Barclays Africa Group Limited‚” Monday’s statement read.

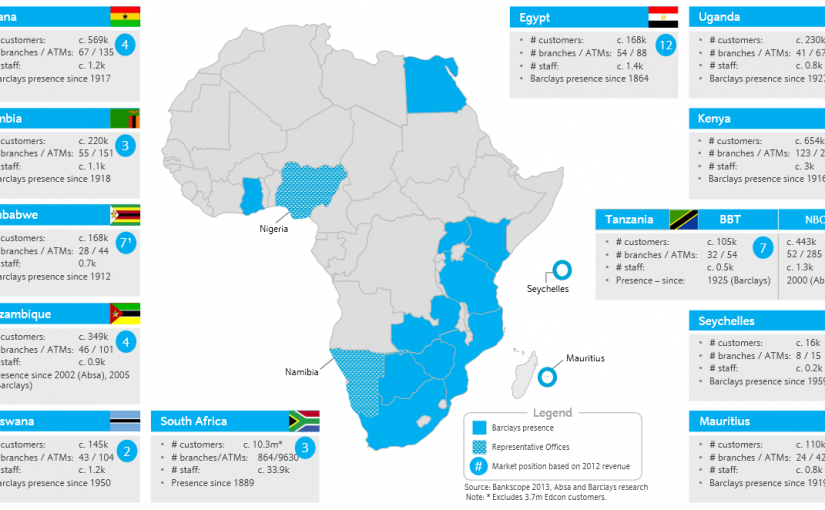

Maria Ramos‚ Barclays Africa Group CEO, said: “We continue to offer a full and integrated range of products and services to more than 12-million customers in 12 countries across Africa, and our customers can be just as confident doing business with us today as they have always been.

“With an independent board and a separate listing on the JSE we are deeply rooted in Africa and remain firmly in control of our future.

“We continue to be optimistic about our prospects in Africa‚ where we have a strong franchise with assets of over R1-trillion. We are deeply committed to the success of our continent. Our destiny is in Africa.”

Fund manager Korner Perspective director Graeme Korner said there was little appetite in the market for a major banking transaction and that finding a new buyer with a good balance sheet was going to be challenging.

“Unless there is a really powerful player that has a deep balance sheet and can add strategic value to Barclays Africa, it’s not in the interest of minority shareholders to see it passed on to somebody else,” he said.

The Public Investment Corporation told Business Day last month it was keen to increase its stake in Barclays Africa if the group’s parent in London were to sell down.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.