Portugal: Relation with former colonies different from other powers - interview

Angola: António Mosquito aims to turn BAI microfinance unit into comercial bank

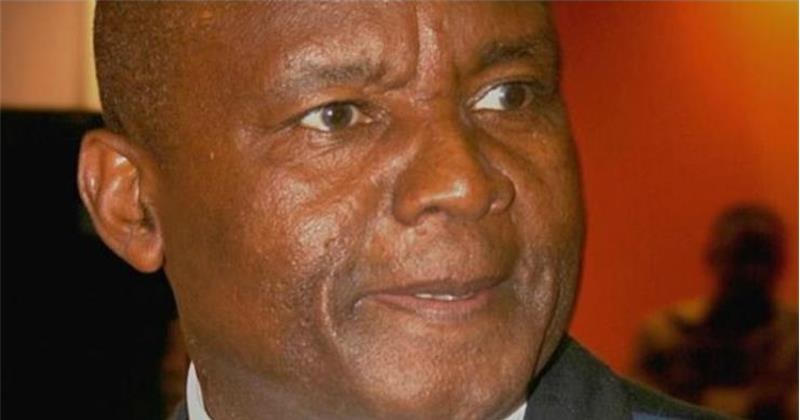

File photo: Expansao

António Mosquito, one of Angola’s most prominent investors and businessmen, who last month signed an agreement to acquire BAI Micro Finanças (BMF), has told Lusa that he plans to turn it into a new commercial bank, rather than its continuing to focus on microfinance.

On 5 August, Banco Angolano de Investimentos (BAI) – a bank in which Angola’s state oil company, Sonangol, has a 8.5% stake – signed an agreement with Mosquito for the sale of its 100% stake in BMF.

According to Mosquito, his aim is to turn the new acquisition into a commercial bank, since it already has all the necessary licences and meets the requirements to operate in Angola.

“The bank will not operate solely in microcredit; it will be a normal commercial bank,” he said, adding that he aimed to differentiate it from the rest of the country’s banking sector, but without giving further details.

Mosquito declined to say how much he had paid for BMF, stating only that guarantees had been put up by Caixa Angola, a bank in which he holds a 12% stake.

The businessman, who is the owner of the GAM group, has interests in the oil, banking, agriculture and construction sectors.

BMF began operating on 20 August 2004 under the name NOVOBANCO, at that time managed by ProCredit, a bank based in Frankfurt, Germany. Angola’s first microfinance specialist, BMF it currently has 21 branches.

In 2009, it was renamed Banco BAI Micro Finanças by notarial deed executed on 30 October 2009.

In 2018, it carried out a capital increase, with its parent company, BAI, subsequently holding 98.41% of the capital, Chevron Sustainable Development Company (CSDC) 0.59% and three other shareholders a combined 0.33%.

In 2020, its shareholder structure was overhauled, with all the minority shareholders selling their stakes to BAI.

At the beginning of August, BAI announced that it was selling stakes held directly and indirectly in two companies, Griner Engenharia S.A (72.6%) and Novinvest S.A. (51%).

BAI’s shareholders approved changes to its articles of association in order for it to be floated on the stock exchange in 2022. The bank currently has 54 shareholders, none of them with significant stakes other than Sonangol.

The shareholders also include Oberman Finance Corp (5.00%), Dabas Management Limited (5.00%), Mário Palhares (5.00%), Theodore Giletti (5.00%), Lobina Anstalt (5.00%), Coromasi Participações Lda. (4,75%), Mário Barber (3,87%), Luís Lélis (3,00%) and others who are not identified by the company and who together hold the remaining 54.88% of the shares.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.