Mozambique: Regulation for data centres and cloud computing services includes sanctions

Mozambique: Mueda and Nangade without banking services for over a month – Carta

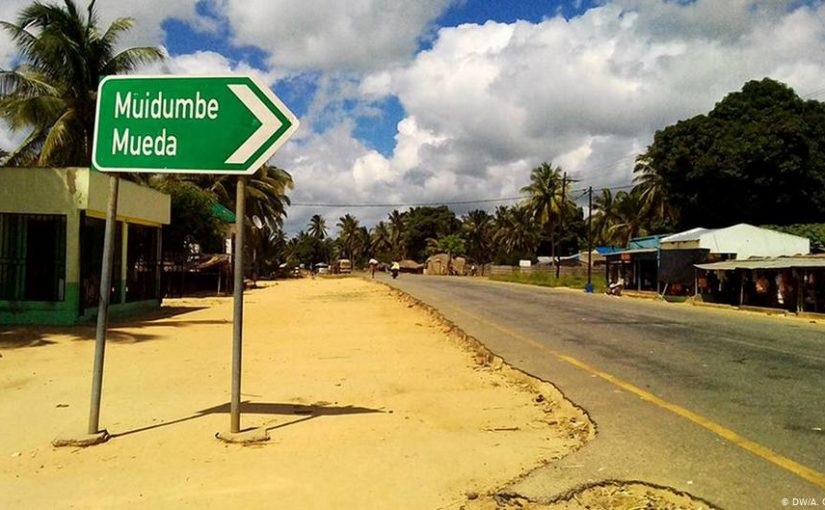

File photo: DW

The districts of Nangade and Mueda in northern Cabo Delgado province have been without banking services for more than a month.

‘Carta de Moçambique’ sources were unable to specify the exact reason for commercial bank branches not opening in those parts of the country, but it is suspected that the climate of insecurity is to blame.

According to sources, the first district to suffer an interruption in the provision of financial services was Nangade, which saw its only branch, of the Commercial and Investment Bank (BCI), close its doors without notice or explanation.

Three bank branches in Mueda district – of BCI, Millennium BIM and Absa Bank – then followed suit.

In Nangade, sources say that the situation is worsened by the unreliability of Vodacom Moçambique’s telecommunications network, which deprives users of, for example, Vodafone M-pesa’s financial services.

The situation means that citizens are forced to travel to Chiúre, Ancuabe and Montepuez or even to Pemba to access financial services, withdrawing money in particular.

Banks were targeted in terrorists assaults on the towns of Mocimboa da Praia, Quissanga, Macomia and Muidumbe, but it was the assault on the main town of Palma that turned the spotlight on the ‘profits’ of the terrorist attacks, whose beneficiaries remain largely unidentified.

In Palma, for example, it is estimated that more than 60 million meticais was stolen from the BCI, Standard Bank and Millennium BIM branches there. The military accuse the terrorists of looting, but sources at the bank suggest the military could themselves be responsible.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.