Mozambique: Government expects capital gains tax from Galp in 2025, 2026

Covid-19: Postponement of gas project in Mozambique worries employers

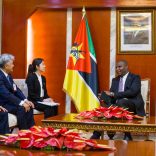

Photo: Lusa

The Confederation of Economic Associations (CTA), Mozambique’s largest employers’ association, says that the postponement of ExxonMobil’s final investment decision for Mozambique because of the Covid-19 pandemic, “does not surprise it”, but confesses to some concern all the same.

Together with ENI, ExxonMobil leads the Rovuma basin Area 4 LNG exploitation consortium off the coast of Cabo Delgado in northern Mozambique.

“ExxonMobil’s decision does not surprise the Mozambican private sector,” Simone Santi, president of CTA’s Mineral Resources, Hydrocarbons and Energy portfolio, told Lusa.

Santi added that there was however concern because “many Mozambican companies and foreign companies in Mozambique have invested in becoming suppliers of goods and services for the project, to develop the sector, by creating value”.

CTA is now forecasting a delay in revenue for companies providing services to megaprojects and as mitigation measure is proposing the creation of a dialogue unit involving the government to verify “Mozambique’s specific conditions” to face the difficulties that the new context may pose.

In the same sense, CTA “advises flexibility on the part of the Government in relation to work visas, taking into account the nature of shifts” in human resources, and making “companies responsible for strict control” of the disease.

The confederation further points out the foreseeable postponement or cancellation of planned milestones related to the hydrocarbon sector because of the impossibility of overseas experts to travelling to Mozambique.

ExxonMobil announced the postponement along with a 30% cut in 2020 capital expenditures and a 15% cut in operating expenses because of the fall in the price of oil and oil products caused by excess supply and low demand following the Covid-19 pandemic.

“A final investment decision for the liquefied natural gas (LNG) project in the Rovuma basin in Mozambique, scheduled for the end of this year, has been postponed,” a statement concerning the project, valued at between US$20 and US$25 billion (€18.3 to 23 billion), one of the biggest ever in Africa, reads.

Area 4 is operated by Mozambique Rovuma Venture (MRV), a joint venture jointly owned by ExxonMobil, Eni and CNPC (China), which holds a 70 percent interest in the concession contract.

Galp (Portugal), KOGAS (South Korea) and the National Hydrocarbon Company (Mozambique) each hold 10% stakes.

ExxonMobil will lead the construction and operation of the liquefied natural gas production units and related infrastructure on behalf of MRV, and Eni will lead the construction and operation of the upstream infrastructure.

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.