Mozambique: Daewoo interested in investing in natural gas projects in the Rovuma basin

Mozambique targets $880 mln in tax from Anadarko takeover – report

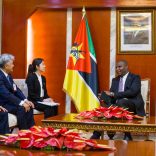

File photo: Reuters

- Anadarko led a liquefied natural gas project in the southern African country, but it was replaced by Total

Mozambique is targeting $880 million in capital gains tax from the takeover of Anadarko Petroleum by Occidental Petroleum, local newspaper O Pais reported on Friday.

Anadarko led a liquefied natural gas project in the southern African country, but it was replaced by Total after the French oil major agreed to buy Anadarko’s African assets as part of the Occidental takeover.

President Filipe Nyusi announced the capital gains tax target after he met Occidental and Total managers in the city of Chimoio, O Pais reported.

ALSO READ: Mozambique LNG: President announces completion of transaction between Oxy and Total – Photos

From Paris to Omaha: How Occidental CEO out-manoeuvred Chevron in Anadarko bid

Mozambique’s economy has been hobbled in recent years by a hidden debts scandal, which prompted donors to cut off funding and deterred investment.

It is banking on its massive natural gas reserves to lift millions out of poverty.

In 2017, Mozambique sought $350 million in capital gains tax from Italian energy company ENI for its sale of a stake in the Coral South natural gas field to ExxonMobil.

ALSO READ: How Total’s CEO pounced on Anadarko’s African energy assets

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.