Mozambique: Foreign exchange sales by banks grow more than 50% in Q2

After spending 1.8 billion meticais, Bank of Mozambique governor prays for new SIMO software … which should only start operating in 2020

Photos: A Verdade

After spending more than 1.8 billion meticais on the two previous software packages purchased for the Interbank Company of Mozambique (SIMO), the Bank of Mozambique on Monday hired the North American company Euronet for the installation of a new computer system for interbank electronic payments in our country. “We pray that its implementation will be rigorous,” said the central bank governor. @Verdade knows that full implementation of the new platform will only happen after 2020.

Eight years after the establishment of the institution which is supposed to provide “a modern, secure, reliable, integrated, inclusive and universally accessible electronic payment system that would make it possible to increase the use of electronic means of payment at national level” and 25 days after the SIMO outage, the main shareholder of the Mozambican Interbank Company has signed an agreement with a US company, founded in Hungary in 1994, to purchase the software to replace that currently being used and which is provided by Portuguese company BizFirst.

“The solution provided by Euronet is a perpetual licensing that responds to the current needs of the market, offers services now available through the SIMO network and new features, presents the advantage of being certified and responds to the requirements of different international payment systems,” Luísa Samuel Nabel, director of the central bank’s legal advisory office, said.

Nabel said that it is “our belief that today a new path towards the unification of all electronic payment platforms in Mozambique is beginning, an objective that can only be reached with the deep involvement of all of SIMO’s credit institutions and financial companies and our partner Euronet”.

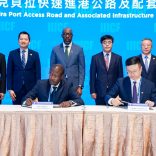

After witnessing the signing of the agreement, Governor Rogério Zandamela, accompanied by the directors and senior staff of the Bank of Mozambique, SIMO managers and the president of the Mozambican Association of Banks, proposed a toast and said: “We pray that its implementation will be rigorous and in line not only with the letter but also with the spirit of the contract that both parties have just signed.”

Migrating from BizFirst to the Euronet IT system will take more than 12 months

@Verdade does not know if the central bank governor is religious, but Zandamela, who was disowned by the government over his determination not to use BizFirst again, may well pray with all religious denominations in Mozambique and indeed the planet , but will have to live with the Portuguese platform for at least the next 12 months, if not more.

It is only after the signing of the contracts in Maputo and, more than likely, the first payment to the North American company, that Euronet’s computer engineers will begin to deal with the solution for Mozambique.

@Verdade has learned from computer engineers with experience in the field that overcoming the bureaucratic formalities is not just about installing new software and then connecting to the platforms that each commercial bank has.

Once the new computer system is installed in SIMO, which will most likely be accompanied by new hardware, engineers will start the development of specific systems for each of the 11 commercial banks that are currently connected to the network, and then develop software for each of the various electronic payment services.

It will then be necessary to link to at least three global credit card providers, among other procedures that require not only the involvement of the SIMO and Euronet engineers but also of each of the institutions whose systems and services need to be connected.

Sources consulted by @Verdade say that each of these procedures takes a minimum of two weeks, recalling that, when one of the commercial banks, with a market share of 16 percent, entered the SIMO network, migration procedures took more than one year.

So migrating more than 2 million cards from the BizFirst software, about 20,000 point-of-sale machines and a little more than 1,000 ATMs to the Euronet IT system will take more than 12 months.

SIBS solution cost 625 million meticais, InterBancos cost 1.1 billion

The @Verdade’s investigations have found that since the Interbanco de Moçambique was created in 2011, Mozambicans have already invested at least 1.8 billion meticais in the company and have “nothing”, as Rogério Zandamela admitted in the Assembly of the Republic.

In the year that the institution began its activities, the Bank of Mozambique reported in its accounts: “The increase in these investments is due to the participation in the Interbanco company of Mozambique (SIMO) of 156,689 thousand meticais.”

At that time, SIMO acquired the software from a Portuguese company that claims on its website: “Between 2010 and 2015 SIBS, in partnership with the local interbank processor, implemented several solutions that are the mainstay of the Mozambican payment system.”

This alleged “pillar of the Mozambican payment system” proved ineffective, having at its peak only 5,000 cards connected, a little more than two dozen POS’s and a dozen ATMs, while costing more than 156,689 thousand meticais in 2012 and as much again in 2013 and in 2014 – a total of 625,568,000 meticais, or about US$20.8 million at the exchange rate of the time.

Sources consulted by @Verdade explained that this amount will have covered not only the costs of the computer system but also IT equipment for SIMO.

In 2015, the year in which the Interbank Company of Mozambique began the acquisition of InterBancos, in the expectation of also buying the ‘Ponto 24’ software that operated the network at that time, the central bank entered 273,593,000 meticais in its Annual Report and Accounts, and an identical amount was reported in 2016.

Last year, to complete the acquisition of InterBancos, the Bank of Mozambique paid a further 645,410,000 meticais. However, according to @Verdade, in this business with InterBancos, the commercial banks, which were left looking like the saviours of Mozambique for joining together to pay off BizFirst’s blackmail demands, were the owners of the company that the Bank of Mozambique acquired for more than 1.1 billion meticais, about US$24.4 million at that time.

@Verdade can reveal that the largest beneficiary of this negotiation, which only served to drain money from Mozambicans, was Banco Comercial e de Investimentos, which at that time held 57 percent of InterBancos.

Paradoxically, none of the former Bank of Mozambique or SIMO officials involved in the negotiations were held accountable.

By Adérito Caldeira

Leave a Reply

Be the First to Comment!

You must be logged in to post a comment.

You must be logged in to post a comment.